Which is better when you need life and critical illness insurance – BTIR or a whole life plan?

A part of being financially savvy involves outsourcing your biggest (financial) risks to a third party (an insurer), but you’d want to make sure you get the best coverage that you need for the least amount of premiums.

But when should you review your life insurance plans? Here are the different life stages where it’ll be good to review your protection coverage and what you need:

- When you get married (increase protection)

- When you have kids (increase)

- When your parents are no longer around (decrease)

- When your kid gets their first job (decrease)

Now the question is, should you buy term or whole life (WL) plans?

When it comes to pure life protection, the answer is simple: if you want the most cost-efficient method, then Buy Term and Invest the Rest (BTIR) is best.

However, it no longer becomes so simple when you add in coverage for critical illness (CI). I compare the difference here.

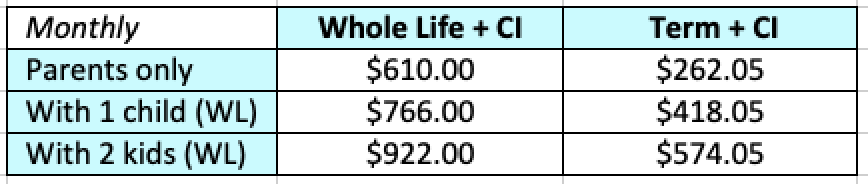

If we presume that the couple wants to purchase life and critical illness insurance for their kid(s), then the couple would potentially be looking at the below instead.

|

| *I looked at WL + CI + ECI for our kid. |

The above table shows how much a family needs to set aside each month for insurance premiums, depending on their preferred plans and the number of children.

Scenario 1: BTIR vs. Whole Life + CI

My preferred strategy, and one that I think most folks who do their own investments would also lean towards (BTIR).

If you can generally achieve 5 – 6% and above on your investments, BTIR works better than if you had locked down the money in your whole life plan. It’ll also give you better returns and a bigger sum for emergencies. Frankly speaking, these returns are not difficult to get, but it involves a certain level of risk appetite.

The problem is, most people I’ve spoken to do a half-hearted approach when they use BTIR, and that is, they buy term but don’t invest the rest. They either don’t invest at all, or even for the ones who do, they invest in risk-free instruments (eg. government bonds) which typically offer less than 3% p.a.

The next question to ask yourself is, even if you invest the rest and do moderately well, will you have the discipline to set aside the sum for your retirement + critical illness coverage instead of spending it on holidays (or anything else!) now?

Another question to think about – don’t forget the withdrawals. At the point when you need money the most, you may or may not be able to sell your investments at their peak. Hence, if you’re going down the BTIR method, it’ll be wise to diversify your portfolio and plan out your withdrawals (you can keep them in short-term instruments and stagger their expiry) so you know you’ll always have a pile of emergency cash to fall back on, while still using it to generate compounded returns for you.

If you have discipline, this would frankly be the best and most cost-effective method. You can lower your cost of premiums down to just several hundred a year in this manner, but the catch is that you need to set aside and invest your own pool of money to cover up the gaps.

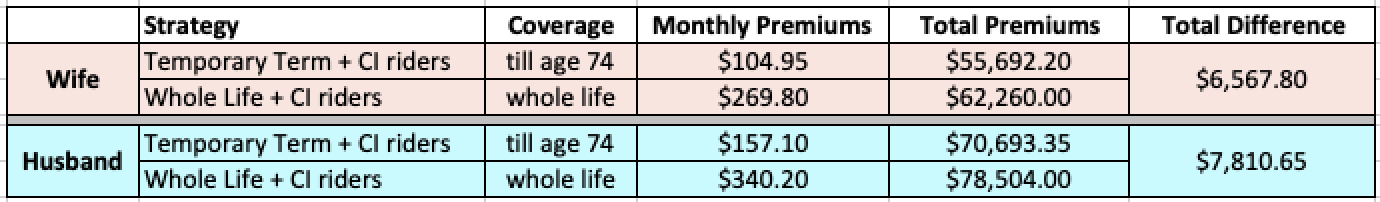

Scenario 2: (Temporary) Term + CI vs. Whole Life+ CI

But what if you don’t, or if you’re worried you won’t have the cash on hand when CI strikes?

In this case, a term + CI plan could do the trick. I’m using term plans till age 74 because it gives a margin of safety for our son in case he wants to pursue a field that requires a longer duration of study, or if he wishes to pursue his Masters first. Also, term plans from age 75 onwards generally start to have a huge spike in premiums, which is what I prefer to avoid.

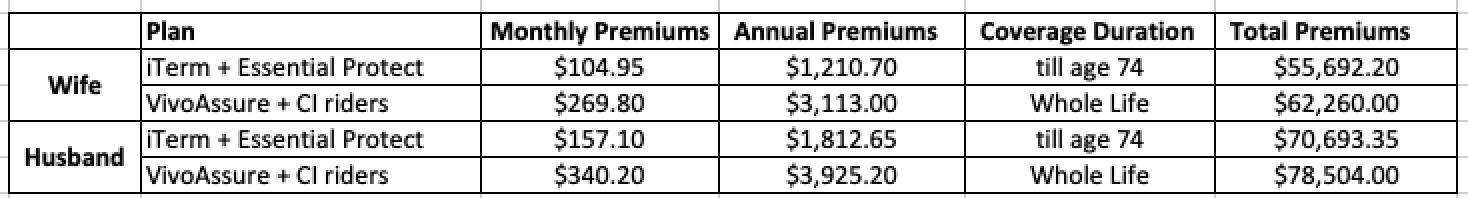

In our case, for the same coverage of $300k, the cost comes up to:

*Coverage for VivoAssure (WL) becomes $100k guaranteed sum assured plus bonuses after age 70, as I opted for a 300% multiplier till then.

*We opted for a limited pay (20 years) on WL which translates into annual premiums being higher in the short term i.e. during our prime working years. Paying till our 60s would equate to a lower annual premium ($2k+) but the total premium paid is then so much higher, which doesn’t make sense to us.

The upfront monthly premiums are more than double if we opt for the WL+CI route, but the total premiums are only about $7k – $8k in difference, which is not much in the grand scheme of things. Between opportunity cost and ease of mind, which would you prefer?

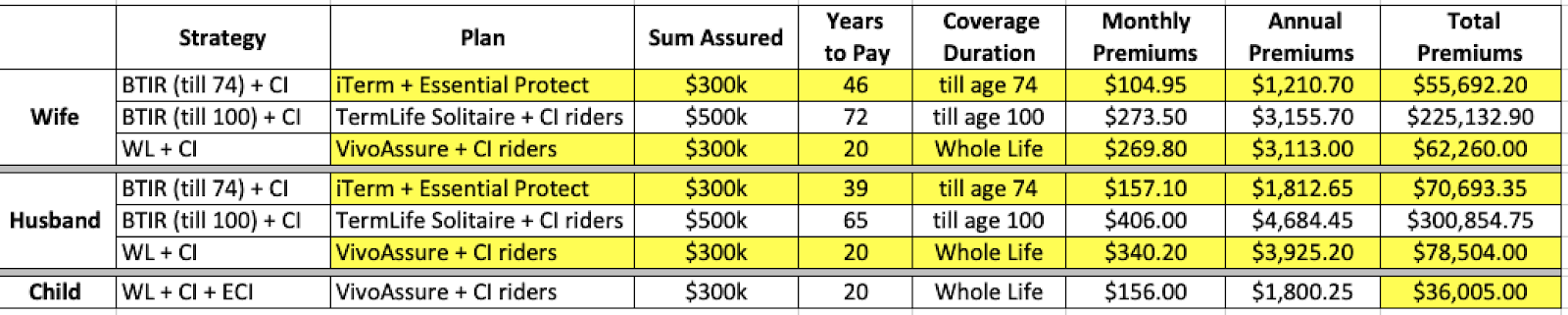

Does it even make sense to get a term plan till 100?

With a better quality of life and advanced medical care and diagnostics today, our lifespans are likely to increase. Some readers have previously asked me if there were term plans covering till end of life, and there are, although these are usually used more for legacy planning rather than protection per se.So a term plan till 100 would address this, while still benefitting parents who are looking to leave a legacy for their child, but cannot afford the higher upfront costs of whole life plans.

Using TermLife Solitaire + CI riders from NTUC Income as an example, you pay $270 (wife) – $406 (husband) every month, which is lower than if you had gone for a similar coverage ($500k per policy) but on a whole life plan. But how do you fund these premiums after you’re retired and no longer drawing an income? Well, I suppose one strategy you could adopt is to ask your children if they wish to take over your payments once they’ve progressed in their careers, since the sum assured will “benefit the family” as either a lump sum payout of $500k (for CI diagnosed, or assuming no claims on CI is made, then the full sum goes to them once you’re no longer around).Presuming they pay for 10 years, they’ll be “investing” $30k (mom) – $45k (dad) in total, but will get $500k by the end of the term (or even $1 million if they pay for both parents’ policies!). That’s even better than any endowment plan they can buy.

I know I wouldn’t have minded paying in this way if my parents had adopted this strategy back then when they were younger. Unfortunately, because they barely had surplus cash, this was not possible back then, and it’ll be too expensive to get one for them now that they’re quite old.

What about insurance for my kid?

Should I get whole life or a term policy for them?

If you’re just looking to cover your child’s life, then my stance is that I would get neither, because the point of a life plan is to provide a payout to the dependents in the event of tragedy. Your child has no dependents at this point in time.

But critical illness is different. In the event that you need to quit your job to care for your child while he/she recovers, the insurance payout could serve to replace your own income during this season, while paying for any outpatient medical costs as well.

If your child is unfortunate enough to get diagnosed with any chronic disease (and you didn’t buy any life plans for them yet), there’s one thing for sure: they will face problems with getting insurance for the rest of their life, or be subjected to unfavourable underwriting.

So if guaranteeing your child’s insurability is important to you, then getting a plan makes sense. In this regard, a whole life plan could be more beneficial because the premiums are low due to their young age, but they get coverage for life. In other words, the total premiums paid by someone who purchases a whole life policy at age 1 vs. age 30 would be very different (eg. $43k lesser using my son and husband as an example, according to our quote from NTUC Income).

But what if you can’t afford the premiums now? Having a baby is already so expensive, and there’s so much to pay for even when they go to school! In this case, I would opt not to even get any life coverage – instead, focus on getting a hospital shield plan and a personal accident plan, and then perhaps a disability income plan if you can afford it.

A disability income replacement plan for yourself to serve the same purpose should usually cost less than your child’s whole life + CI plan premiums. In our case, it would be 70% cheaper. The catch is that your child won’t be guaranteed insurability for life if you choose this method.

———————————–

TLDR / Summarised Thoughts

There’s certainly an argument to be made for getting whole life + CI plans for the whole family of 3, but only if both parents have financial leeway to pay about $750 in premiums each month.

Otherwise, getting term+CI on the parents and WL+CI for the child would cost lesser at $420 a month – almost 45% cheaper.

To sum it up, here are some general observations from reviewing the family’s insurance coverage recently:

1. If I want life and critical illness coverage, the difference in total premiums between a term and whole life plan is hardly much (less than $8,000).

- That’s much lesser than I expected, and in this regard, it seems like a whole life plan offers more value and peace of mind, for the trade-off of more expensive premiums upfront for a shorter payment duration.

2. A whole life plan for one’s child is a great gift to ensure guaranteed insurability and cash, provided the parents can afford it.

- In the event of critical illness, the sum paid out can also allow one parent to potentially quit work and stay home to care for one’s child.

What should you decide? As always, evaluate first your needs and budget.

While it sounds great to have as much protection as possible, affordability should your primary consideration because there’s hardly any point to run into debt just to get insurance. While stuff like leaving behind a legacy sum for your child and guaranteeing your child’s insurability is no doubt important, these are secondary if you don’t have enough cash on hand to maintain the premiums.

Differentiate between your needs and wants for insurance based on how much you can afford, and then choose the best plans for you.

Disclosure: This article was sponsored by NTUC Income, so the examples used are their plans, which are also among Singapore’s most competitive. However, for a detailed quote and financial planning, you’re encouraged to seek out a trusted advisor instead of making your decisions regarding insurance purely based on this article, or any other articles you read online. Premiums used in this article are for myself, my husband and my son respectively, so they may or may not be reflective of the premiums you will need to pay for your case as your age, smoking status, medical history, preferred sum assured, riders, and more will likely vary.

*** Sponsored Message by NTUC Income ***

Whether you prefer term or whole life insurance, we’ve got you covered. Want a term plan? TermLife Solitaire covers you for $500,000 coverage (or higher) with competitive premiums.

Want peace of mind with a whole life plan? Check out VivoAssure (with Advanced Assure Accelerator rider), which not only covers you for life, but also guarantees you protection against unknown diseases as long as you undergo surgery or suffer from infection, and require a stay of 5 days or more in ICU. Not all diseases are known, and we’ll cover you against even the unknown so you can sleep peacefully at night.

Show your family how much you truly care. Protect them with a NTUC Income life plan today.

2 comments

This calculation can change substantially and the cost gap will be much bigger if you consider the much lower costs of buying the online term plans vs the WL which is not sold direct.

or if one goes for a term with a lower sum assured too!

These findings were surprising to me because I've previously looked only at BTIR vs WL, and always thought the cost differences for the same level of sum assured would be tremendous, but it seems like the gap isn't as big as I had thought it to be. Now it really boils down to one's preferences and what they prioritise – discipline + paying the least but paying all the way even in this age of increasing job redundancy (term) or a paying more upfront for a limited time during one's prime working years and being covered for life without worrying about anything else later (whole life). It really is a case of choosing between the opportunity cost of time and money now and in the future!

Comments are closed.