How many of these are you guilty of?

The first mistake is often observed among young working adults and singles, as most of us tend to think we are invincible at that age and life stage (some risks only become more visibly obvious as we grow older).

The opposite also happens, often to parents (who are overly kiasu about their kids) or those who felt pressured into buying plans to support their friends in the line.

The third happens when you don’t review your financial portfolio on a regular basis. This was me just a few months ago, when I realised I had been unknowingly paying (via GIRO) for a rewards membership programme despite not having used it since becoming pregnant in 2018.

But more worryingly, I find that most people are guilty of the final mistake on the list, where they have various insurance policies but none (or too few) covers their highest-probability events.

Here’s a better plan

A better way is to weigh the odds that are stacked against us and insure against those accordingly.

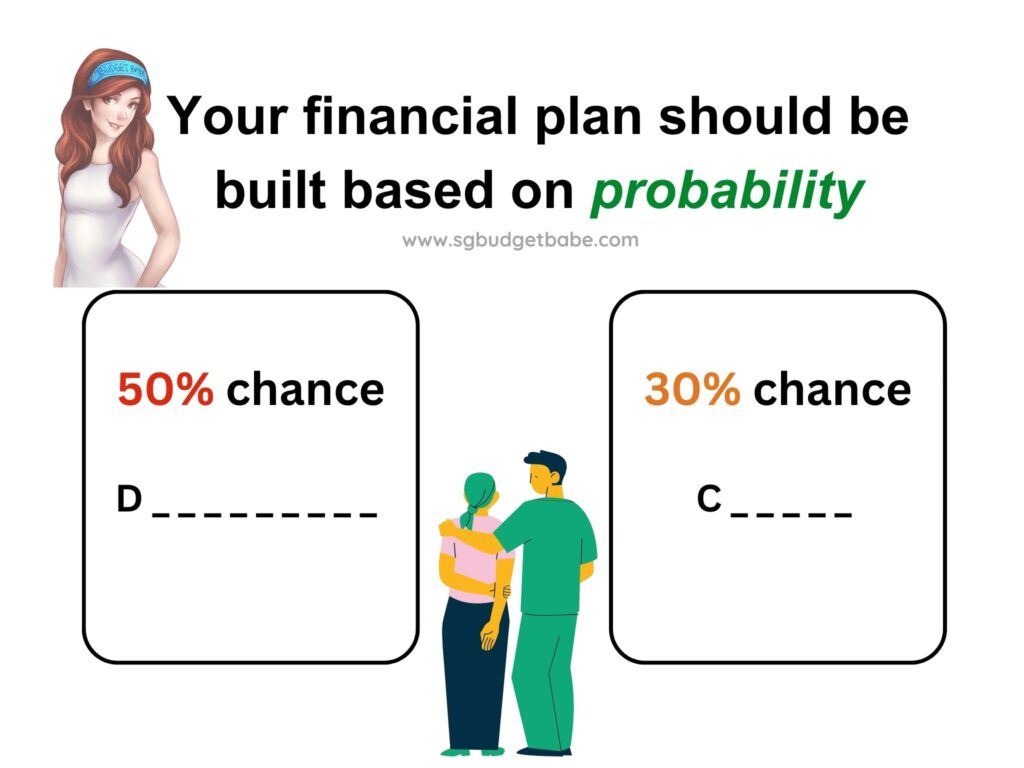

And if you asked me, the highest probability event for most of us is disability.

That’s because even MOH estimates that “1 in 2 healthy Singaporeans aged 65 could become severely disabled in their lifetime, and may need long-term care”. Considering how the average life expectancy of a Singaporean is now at 83.7 years old, that means our odds for disability are stacked at 50%.

While most of us already have minimum protection against disability – thanks to CareShield Life – the reality is that the payouts can only provide some basic support and might not be enough to cover the average costs of long term care.

Not sure what CareShield Life is? Read more about the national severe disability insurance scheme and how it fits into your future plans here.

You can judge by asking yourself, do you reckon S$600 a month will be enough if you’re disabled? Since S$600 is already insufficient today, what more in the future when medical bills and caregiving expenses are bound to be higher?

The solution: get a CareShield Life supplement, if you haven’t already with Singlife CareShield Standard/Plus.

My husband and I have personally boosted our own payouts to above S$2,000 – because that’s how much we suspect will be needed at a minimum to pay for long-term care each month, and we don’t want to burden our kids with having to pay that for us.

Pro tip: even if budget is an issue, you can potentially still secure a higher disability coverage for yourself for free. That’s right – as long as you have S$15,000 in your MediSave account, you would already be getting at least S$600 worth of interest every year, which means you can pay your premiums without forking out any additional cash (especially if you have yet to utilise your MediSave for any CareShield Life or ElderShield supplement).

Another worry that keeps me up at night is that of cancer.

It is no secret that cancer is the #1 cause of deaths in Singapore, as reported by MOH. Since 2016, cancer alone is the cause of nearly 30% of deaths here, and the cost of cancer treatments have been rising over the years.

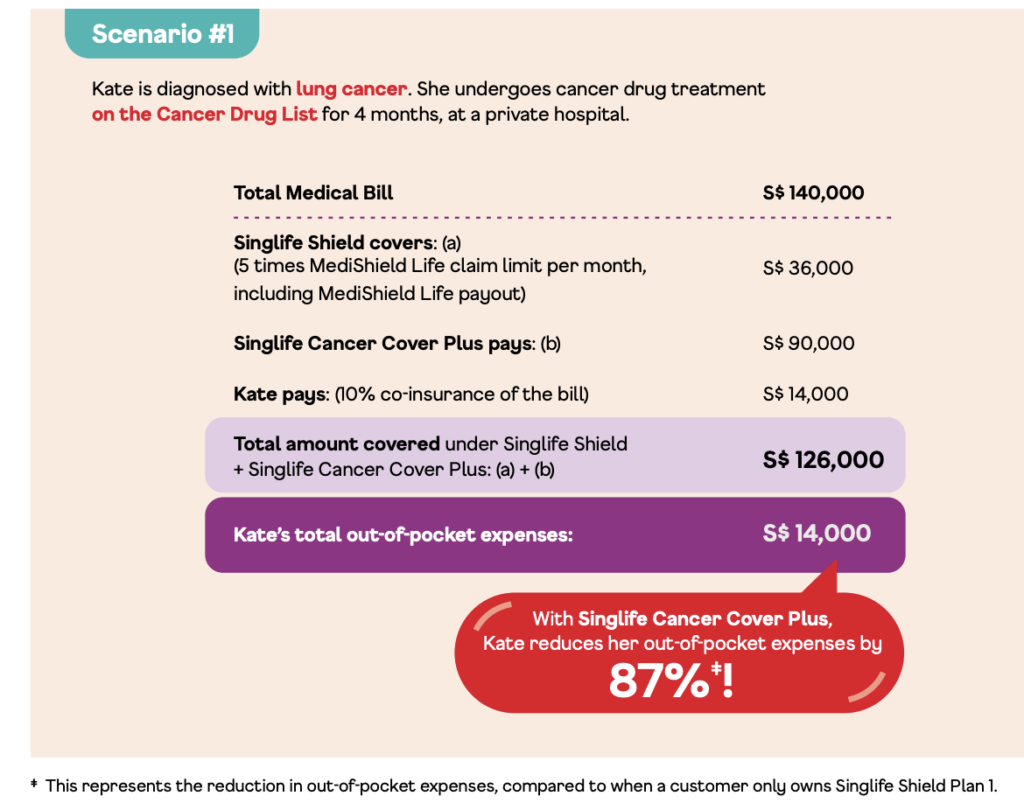

I’m in my 30s, and I already know of several friends in my circles who have gotten diagnosed with cancer. Thankfully, they managed to beat cancer and are in remission right now, but the costs can be scary (two of my friends spent over $100k in their battle against it). I recently also read another story (here) of how one woman in her 30s dealt with cancer and saw how it’s possible to bounce back with the right support – financially and otherwise

While our government is making an effort to stem rising healthcare costs, the problem is that for the individual, we’re the ones who will have to deal with the reality of potentially huge out-of-pocket payments which most of us may not have the cash for. And since we cannot control the size of our bill, there is no saying how much we might end up having to pay.

That makes it hard to plan. After all, no one likes the thought of how one’s lifetime savings could easily end up being wiped out in a single instance because of an unexpected medical condition, or even worse…end up having to borrow.

And now that even patients on IPs will only be covered up to a maximum of:

S$18k a year (i.e. S$1,500 a month) for cancer services, it means that our cash portion will be even higher.

Note: The $18k limit is computed based on 5 times of the MediShield Life $3,600 cap.

The government has also said that 30% of Singapore residents do not have Integrated Shield Plans, and among those who do, only less than half are covered under riders.

If you don’t want money to hold you back from getting the cancer care that you reckon is best for you, then you may want to go for a plan that provides as-charged coverage for claims, such as Singlife Cancer Cover Plus with a high annual coverage limit (up to S$1.5 million).

Your odds can also fluctuate in the short-term, such as when you travel. In this case, it’ll be better to adapt accordingly.

How I do it is to lock in my coverage for higher-probability events, but maintain flexibility for the rest.

Travel insurance, for instance, is an area where it pays to have more flexibility. There is absolutely no need to commit to an annual travel insurance policy if you make just a couple of trips each year. What you could do instead is to buy from whichever insurer that is running a promotion at the point of your trip.

However, if your bigger issue is having an unpredictable schedule (e.g. if you’re the boss of your company / self-employed / have young kids who fall sick often), then a travel plan that I keep coming back to is Singlife Travel Insurance, as it is the only insurer that pays us should we have to cancel our trip for any reason that could not have been foreseen beforehand e.g. if your child suddenly fell sick (even if it’s just a nasty flu).

Pro tip: You can enjoy up to 48% off single-trip plans* if you’re an existing MINDEF / MHA policyholders or a family member of one!

Of course, while these are some key coverage areas I typically pay more attention to, your needs may differ from mine. Hence, don’t make the mistake of simply following generic advice when it comes to insurance; you should know that there is NO “one-size-fits-all” coverage portfolio.

Instead, look at the big picture of your finances, and figure out what policies best fit your needs (be it to protect, save or even invest).

Disclaimer: This article is brought to you in partnership with Singapore Life. All personal opinions are that of my own.

Sponsored Message

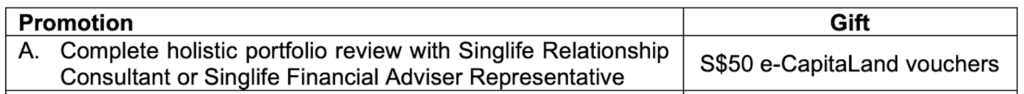

Need another reason to complete your own holistic financial review? Well, if you commit to doing so before 30 June 2023, you can get a S$50 e- voucher for redemption across any CapitaLand mall in Singapore when you book and complete a review with Singlife here!

*Promotion and Policy Terms and conditions apply.

This policy is underwritten by Singapore Life Ltd. Budget Babe is not an insurance agent/intermediary and cannot solicit any insurance business, give advice, recommend any product or arrange any insurance contract. Please direct all enquiries to Singapore Life Ltd. This material is published for general information only and does not have regard to the specific investment objectives, financial situation and particular needs of any specific person. You should read the Product Summary and seek advice from a financial adviser representative before making a commitment to purchase the product. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premium paid. Buying a health insurance policy that is not suitable for you may impact your ability to finance your future healthcare needs. This advertisement has not been reviewed by the Monetary Authority of Singapore. Protected up to specified limits by SDIC. Information is accurate as at 24 May 2023.