(A letter to all the insurance agents I’ve ever encountered and what I wish I could tell them.)

Dear insurance agent(s),

Please stop hounding us at MRT stations and bus interchanges. We really are not interested, especially when we’re rushing to get to our next destination or to our next appointment. It really isn’t nice to stop us in our tracks when we’re rushing, and no, following us around doesn’t make you look any better.

|

| Image source: Hardwarezone |

Please stop trying to entice us with “freebies” or hiring pretty “xiao mei meis” to ask us to do a “survey”. We’re not stupid, we know there’s no free lunch in the world and you’re just trying to get us to sit down for a consultation. We understand you’re having a long and hard day doing your roadshows, but we’re not the right leads you’re looking for either. And a short-term freebie in exchange for a long-term (more expensive) plan isn’t a good deal for me, no matter how you market it.

Please don’t call me out on the pretext of “catching up” with an old friend if you’re simply trying to suss me out and sell me insurance. We’re all adults now, so let’s not waste each other’s time. If you genuinely value our friendship and wish to catch up, I’ll be honored(and it’ll be great if you could help me with my insurance gaps too), but there’s nothing wrong with telling me that you’ll like to share with me more about your new job in insurance too so I can decide whether I want to meet up with you. No one likes feeling cheated, particularly by an “old friend”.

|

| Image credits |

Please stop calling yourself an “expert”, because every single agent out there claims the same for themselves. Just get to the point, or you could focus on how many clients you’ve served, how many years you’ve been in the business, or tell me about difficult claims that you’ve successfully been able to get for your clients recently. Let me be the judge of whether you’re truly an “expert” or not and whether I want you to serve me on my policies, and not the other way round.

Please stop making me sit through your MDRT / customer testimonials at the start of your every pitch. No one likes being forced to listen to someone else boast. Yes, your MDRT status might be difficult to achieve, but all I see is million dollar round table = you earned a lot of commissions from selling products to many clients. Will you really have my interests at heart, or if you really have that many clients, will you then have the time to properly serve me on my claims when I need you?

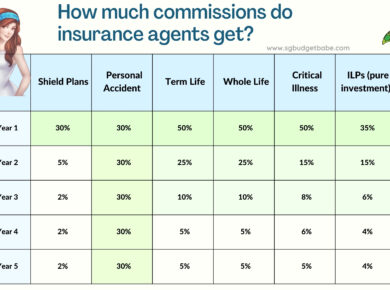

Please stop trying to sell us high-commission plans. We know you’re just trying to make a living and feed your family, but to do so at the expense of our trust and money isn’t the right way to earn your keep. Just like yours, our money is hard-earned too, you know.

Please don’t ask me to switch my policies just because you’ve just changed companies, unless you really think it is better than that last policy you sold me. And if that’s really the case, then my next question is, why did you sell me that policy instead of this one back then?

Please be a real adviser, and not one in disguise as a salesperson. There’s a world of difference between a salesperson, a product-pusher, and a real financial adviser. The reason why we consumers come to you is because we either don’t know how or have no time to look at all the different market offerings by ourselves. We look to you for advice, so please don’t break that trust.

Please identify my protection gaps, instead of identifying sales gaps for you to take advantage of. Yes, I may not have any investment-linked or endowment plans, but that doesn’t mean it is an opportunity for YOU to sell me one. Because, you know, maybe the reason why I don’t have them is because I’m doing my own investments and savings and don’t see a need to pay you / your insurer for you to manage it for me.

Please stop making wild claims and putting me down. If I say I don’t want an investment-linked plan (especially when I do my own insurance and am satisfied with my own performance thus far), that doesn’t mean you should come in and make wild claims like how you can earn 30% per annum for your clients. I’m not stupid, and neither are you Warren Buffett.

Please stop claiming your company’s policy is THE best, especially when you’re so ill-informed of the other choices out there. It is your job to educate us, and not the other way around. Plus, do you know how ignorant you appear when you simply reiterate that yours is the best without concrete evidence or comparative factors to back up your claims?

Please really get to know your T&Cs. It looks bad on you when we spot something that you didn’t tell us about. (I spotted a $30k claim limit on an insurance policy that an agent sold me for $90k only after the free-look period…and I wasn’t informed about it at all, or I wouldn’t have bothered adding the multiplier).

Please don’t join the profession if you’re only in it for the money. Insurance is a noble job, but it is also one of the most challenging in today’s retail markets. And if you’re only in it for the money, you’re more likely to give up and switch jobs once a better opportunity comes along. What happens to all the customers you leave hanging behind, then?

Please do think more highly of yourself and your profession. Insurance and protection are like firefighters – we (consumers) all need them, but we also tend to think we can put out the fire ourselves (until it gets too big for us to handle).

Please don’t be afraid of the robo-advisers or AI; there’s no way they can ever replace your role. A robot cannot identify and relate to my emotional needs, but you can. As a child and parent yourself, you’ll be able to understand why I need and want to prioritise certain financial goals ahead of others. You’ll be able to tell me otherwise when I think I know better about what I need and want, when in reality I’m not doing what’s best for me at all (because I’m not trained like you!). No robot or AI will ever be able to do that.

Please put my needs above yours. That’s what your job is ultimately about – helping me identify and fill my gaps in my personal finance journey, and not mainly about filling your own pockets. And when you do my policies right, I’ll not only stick with you for a longer time, but also recommend my friends and family members to you. That’s the hallmark of a good agent.

Please put my needs above yours. That’s what your job is ultimately about – helping me identify and fill my gaps in my personal finance journey, and not mainly about filling your own pockets. And when you do my policies right, I’ll not only stick with you for a longer time, but also recommend my friends and family members to you. That’s the hallmark of a good agent.

Last but not least, please don’t give up. I know that day in and day out you’re faced with multiple rejections and that surely cannot be easy for anyone. Sometimes you get rude and unkind customers too. But remember why you joined in the first place – to save and protect people from becoming financially ruined. That, will take you through the toughest days.

And I promise, when you do your job (of advising us) well, we really do appreciate it.

Sidenote: I shared these sentiments with DIYInsurance recently as well, and they told me that they’re planning something to address this feedback and consumer wishes. While there’s been more talk about robo-advisers and artificial intelligence coming in to disrupt the insurance space, and possibly taking over the role of insurance agents and financial advisers, I remain skeptical. DIYInsurance has therefore told me that they’re in the midst of launching something that will offer the best of both worlds – to make use of technology to do what humans cannot do as well, while allowing human advisers to continue doing what humans do best (and what robots cannot). I don’t know exactly what they have up their sleeves yet, but it does sound like something big, so I guess we will know by next month?

I’m excited, and am looking forward to see if what DIYInsurance will be unveiling will truly be a gamechanger in this space! Let’s wait and see.

With love,

Budget Babe