When I was growing up, my parents used to pay my helper her salary in cash. However, I’ve not adopted the same practice – mainly because I hardly ever use cash anymore. In fact, even MOM encourages employers to pay their domestic workers’ salaries electronically (see source here).

When you pay your helper’s salary in cash, there won’t be a receipt trail to prove that you’ve indeed done so, which could become a real problem in the event that they ever dispute it. We’ve all heard of the horror stories where helpers run away and claim that they were ill-treated by their employer(s), including being paid late – this becomes a non-issue when you use electronic payments such as internet banking.

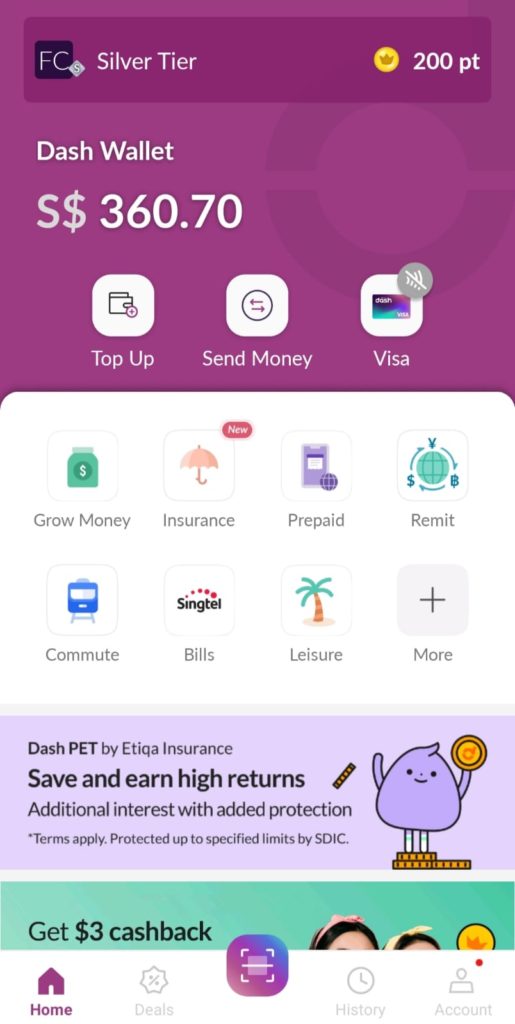

Another alternative you can consider is to use Singtel Dash, especially if your helper already has the app installed! This way, you can literally transfer their salary within seconds.

Remit money overseas to their hometown

It used to be a common sight to see helpers queuing up at Western Union (or at other remittance companies) to send money back home. However, ever since the lockdowns last year, my helper no longer goes out as often as before, which is why she changed the way she remits money to her family members in the Philippines.

Imagine my surprise when she told me about walking to the nearest 7-11 and getting the counter guy to top up her Singtel Dash wallet so that she can send money to her family using the Dash app. This also allows her to track the status of the remittance (something she wasn’t previously able to do when she remitted over physical counters), so she can send a copy of the remittance receipt to her family member(s) to reference as well.

She reasoned that this helps her to avoid the long queues at the remittance shops in Lucky Plaza, so if you’re worried about your helper potentially catching COVID-19 from crowded places, this is a really good alternative!

You can do this on the Singtel Dash app in a few easy steps. Here’s how:

1. Select “Remit” on the homepage (follow the on-screen steps to register if this is your first time remitting money)

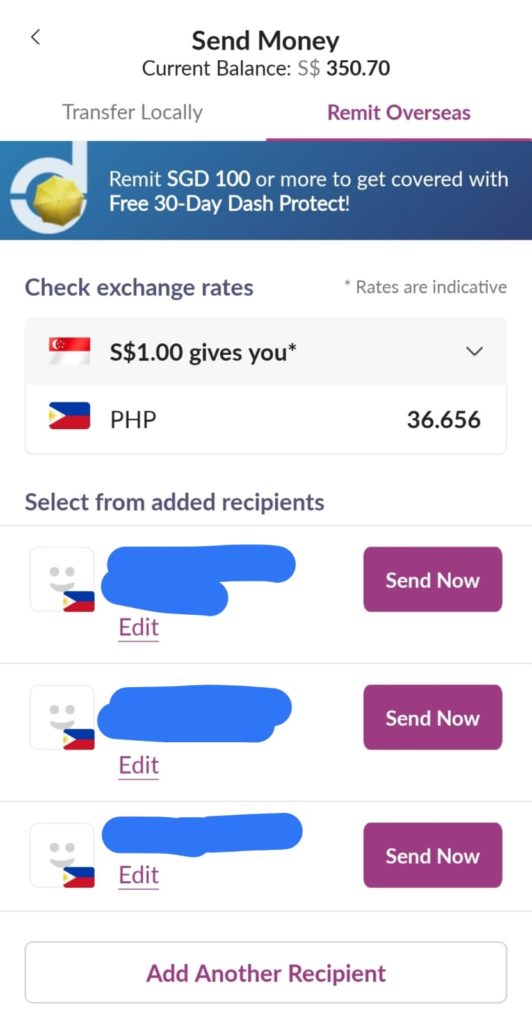

2. Select “Remit Overseas” and choose the country/currency that you want.

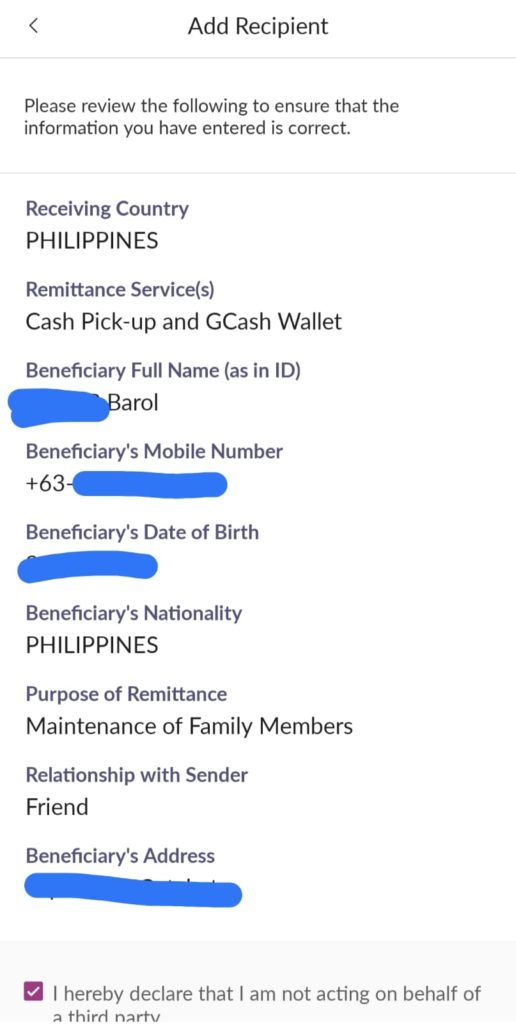

If you don’t already have the recipient in your records, you can simply “Add Another Recipient” and key in their name, birth date, phone number and address. (Your helper should be able to pass you these details. Note that the address doesn’t have to be very specific – in our case, it was just 3 words showing the municipality in Philippines.)

3. Select the preferred mode of pick-up.

And you’re done!

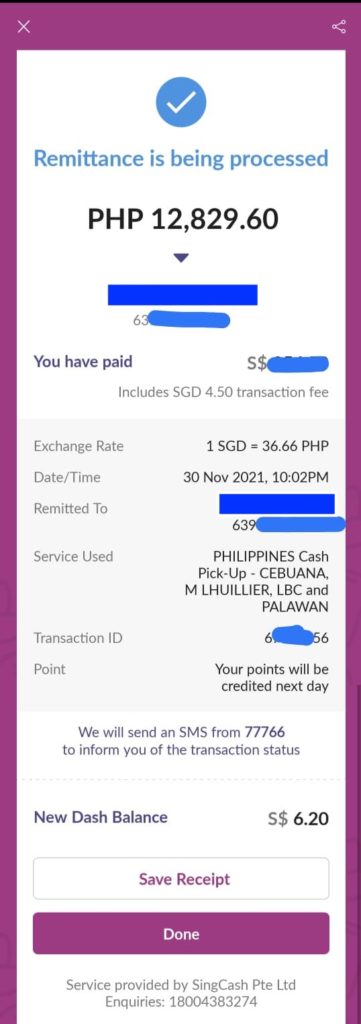

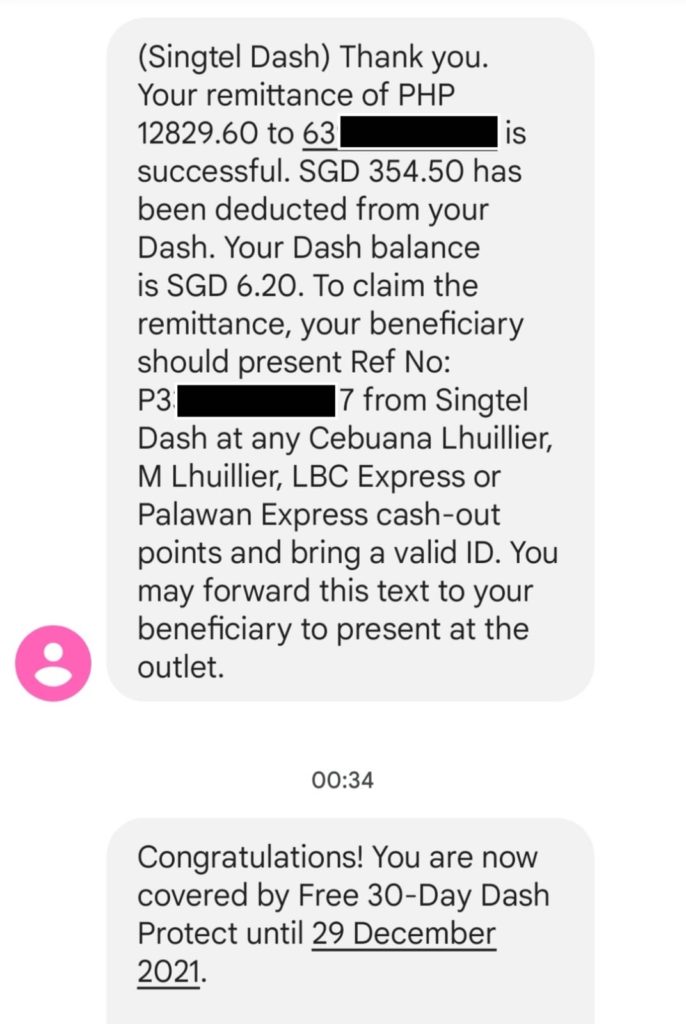

An SMS will be sent once the remittance is completed, which can then be shared with your helper’s family to collect the cash at their preferred outlet. Note that the entire process happens within minutes – if the cash pick-up option is chosen, the money arrives in 15 minutes, so your helper can basically tell her family member to stand by at the remittance or phone shop (LBC, Palawan or M Lhuillier) and show the receipt to retrieve the money!

Select GCash and the process is even faster – just 5 minutes for the cash to arrive! If your recipient has GCash in the Philippines, they can use the remitted funds as a mobile wallet to pay for stuff, or even cash out directly (if they prefer to do so).

Note that you may have to wait if you select bank account transfer, as that takes anyway from 15 minutes to 2 banking days (in the Philippines).

Are the exchange rates competitive?

Most of you might be wondering this (as I did), and so I went to check out how the rates on Singtel Dash fares among the other commonly-used options:

| Remittance via | Rate for SGD 1 |

| Dash | 36.669 PHP |

| Western Union | 36.70 PHP |

| Brunphil | 36.65 PHP |

| Metrobank | 36.65 PHP |

| Pay2Home | 36.62 PHP |

Pretty competitive indeed. I also like how transparent the fees are in being communicated upfront to users (like the FX rate and $3 – $4.50 remittance fee to the Philippines in my case) with no nasty hidden fees to surprise us.

What’s more, when your helper remits money home, she can also get a complimentary 30-day Dash Protect insurance if the remitted sum is S$100 or more (excluding fees). This is a free personal insurance coverage underwritten by Income, which covers the person who made the remittance for accidental death and permanent disability. You can refer to more details on the policy here.

Don’t forget that Dash reward points are also awarded for each remittance made! These can then be used to redeem for various vouchers, such as Shopee discount vouchers or hi! card top-ups.

This is why as an employer, you should definitely consider assisting your helper on how to download the Singtel Dash app and do the remittance by herself.

Got a helper who’s not from the Philippines? Don’t worry, because you can use Singtel Dash to remit money to other countries too i.e. Malaysia, Indonesia, Myanmar, India, Bangladesh and China.

If you’re an employer looking to assist your helper in remitting money home, you can reference this step-by-step guide as well.

Purchase discounted maid insurance on Dash

My first maid insurance agency was from a smaller insurer in Singapore, which was an arrangement set up by the agency where I hired my helper from. I tried asking if I could switch, but wasn’t given the chance to do so (which I suspect is because they earn a partnership or referral fee…) even though I pointed out that the plan was more expensive than other online options that I had found.

So once the 2 years of her contract was up, I immediately switched to a more competitive insurer ahead of renewing her contract. After doing my research and comparisons, I settled on Etiqa, because they were the most affordable plan in town.

Last week, I renewed my helper’s insurance policy with Etiqa via the Dash app because it gave me a 25% discount – the best I could find right now! Premiums start from $138.42 for Plan A (14-month coverage) – mine was $195.72 after GST as I opted for coverage between Dec 2021 to Feb 2024 as we renewed her contract for another 2 more years.

What’s more, by buying within the Dash app, you can get an extra 2,000 points (note: to be eligible, the mobile number that you indicate for the maid insurance policy MUST be the same as your Dash registered mobile number) which gives you access to even more freebies.

It was thus a no-brainer decision for me to get my maid insurance via Dash 😉

Other benefits of using Dash

Of course, your Dash app can be used here in Singapore for various payments as well, including paying via QR code (Fave, hawkers or PayNow) or Visa. For instance, I’ve used mine to pay for food at the hawker centre whenever I’m out of cash, as well as on various MRT/ bus / taxi rides.

And of course, if you’re a Singtel user, then you MUST use Dash to pay for your mobile bill because you can get an extra 1GB of data by doing so!

I hope this article helps all of you who have a foreign domestic helper (like me). Definitely go try out Singtel Dash – while this article is sponsored by them, views are entirely my own, and long-time readers would be familiar with how I’ve been using Singtel Dash long before this 🙂

Sponsored Message

Yet to get started on Singtel Dash? Here’s some good news and sign-up bonuses:

Get up to $20 cashback when you download and sign up for Dash using promo code DASHBABE and make eligible transactions* by 31 December 2021 (such as a minimum of $3 payments, remittance of S$100 or more, signing up for Dash PET, etc). Full details here.

If you intend to refer your helper to Dash for her to remit directly by herself, you can send them your unique referral code (found on your Dash app) so you can get $3 cashback when your helper makes her first remittance (min. S$100 nett of fees).

Disclaimers: These policies are underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract. Protected up to specified limits by SDIC. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This advertisement has not been reviewed by the Monetary Authority of Singapore. Information is accurate as at 13 December 2021.