Recently, there has been much ado about nothing over whether or not finfluencers in Singapore need to be licensed. And thanks to the direction of the news coverage, many people are now under the mistaken impression that finfluencers (including yours truly here) now need to be licensed.

Let me clear the air once and for all:

Finfluencers do NOT need to be licensed in Singapore.

This huge misconception started on 13 November, after the Straits Times published a news article with the following choice of headline:

As a result, it has caused a big hoo-ha over nothing, including reactions from various other media outlets that have continued to pick up on this piece of news (which I deem as misleading), especially considering there has been no change to MAS’ stance regarding finfluencers.

There are a few key facts to be pointed out here:

- Over the past five years, MAS had received an average of fewer than five complaints per year against finfluencers.

- MAS and the Commercial Affairs Department will take enforcement action against individuals providing financial advice without a licence. Enforcement action has been taken against six individuals, none of whom was a finfluencer, over the past three years.

- A finfluencer who provides financial advice will have to be appointed as a representative of a financial advisory firm.

- The authorities regularly advises the public to deal with and invest through only persons regulated by the MAS.

Unfortunately, anyone reading just the news headlines instead of diving into details and getting the word from the horse’s mouth directly (i.e. the Monetary Authority of Singapore, in this case) has completely missed the point – or worse still, grossly misinterpreted the entire situation.

In our finfluencer circle, many of us have since been questioned by various brands and financial institutions (who work with us for advertorials or sponsored educational pieces) and asked to show proof of our licence.

Yet, we do not have one, because there currently exists no licence that allows for us to operate the way we do without having to solicit or meet sales KPIs.

The current requirements to be eligible for and apply for a financial licence are outlined by MAS here. There are different licence types and exams for each different type of financial service and investment class of product. An insurance agent has to sit for insurance exams in order to give you professional advice on insurance products and policies. An investment banker needs to sit for investment-related exams (and there’s a whole bunch for the different classes of investment products) before he can advise you on them.

Even though your personal finances span across your insurance coverage, property net assets and investment portfolios, there is no single licence that will allow anyone to give you advice across all of these in Singapore. Let’s get this straight.

What’s more, MAS has made it very clear that only “individuals conducting financial advisory activities on behalf of licensed FAs or exempt FAs need to be appointed as representatives”. In Singapore’s current finfluencer landscape, there are only a very small handful of finfluencers – defined as individuals or media brands who covers finance-related topics and have a significant social media following online – who conduct these financial advisory activities. The ones I know of do indeed hold a license and go on to accept or manage their followers-turned-clients’ funds for them.

Finfluencers like myself, The Woke Salaryman (500k followers) Kelvin Learns Investing (100k followers), Adam Khoo (1 million followers) or even trader Rayner Teo (2 million followers), do not take in our followers money to invest or manage it on their behalf. Instead, what we put out is financial education i.e. explain financial concepts, facts, pros and cons, etc. We regularly teach our followers how to become better at managing their own money.

Because of the aftermath, I have since written to the authorities to clarify directly if media brands such as SG Budget Babe (and a few of my finfluencer friends) are required to be licensed as a result. Here’s MAS response:

“We would like to assure you that there is no change in MAS’ policy position and the two-stage test in the Guidelines on Provision of Financial Advice remain relevant in assessing whether a person is carrying on a business of providing a financial advisory service.

In this regard, content which are factual information on financial terminology and basic features of insurance or investment products, as well as general, non-personalised considerations on the importance of savings (e.g. tips for savings or spending wisely) or what a consumer should look out for before purchasing financial products, would not be considered financial advice.

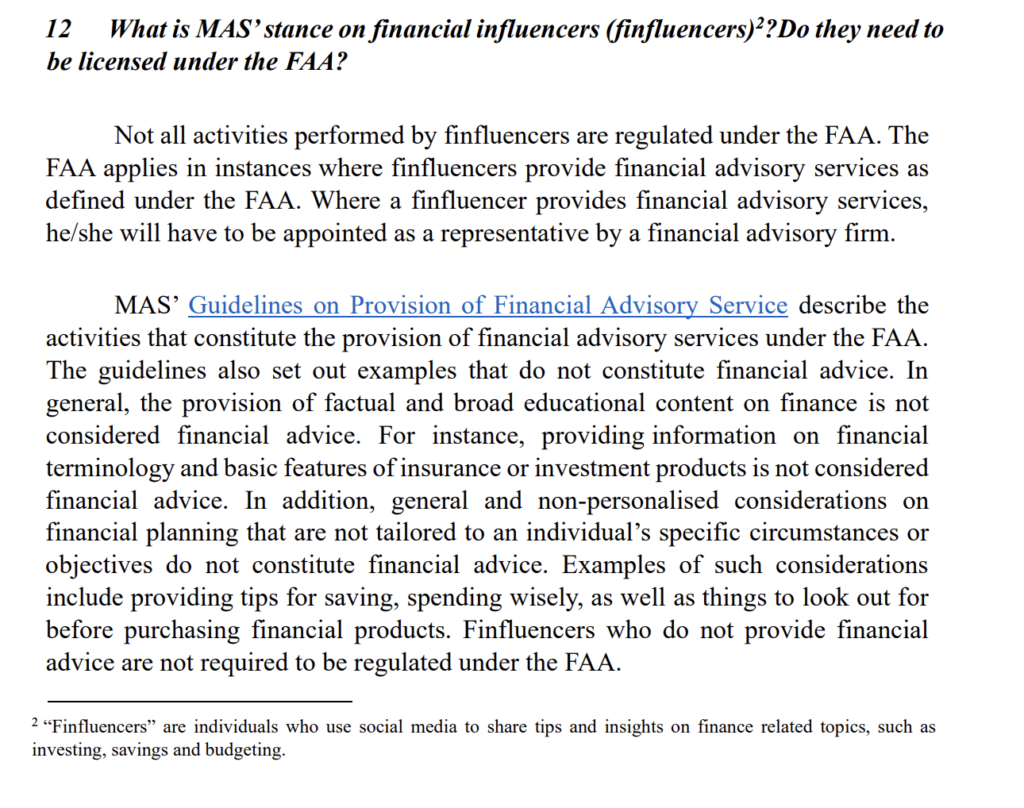

We have updated the FAQs on Financial Advisers Act, Financial Advisers Regulations, Notices and Guidelines (see Section I FAQ 12) to clarify MAS’ position on whether finfluencers require licensing under the Financial Advisers Act. Finfluencers should apply the two-stage test to evaluate whether their activities amount to the provision of financial advice.”

The updated guidelines by MAS, published very recently on 28 November 2024 here, clearly state here that the majority of finfluencers do not need to be licensed:

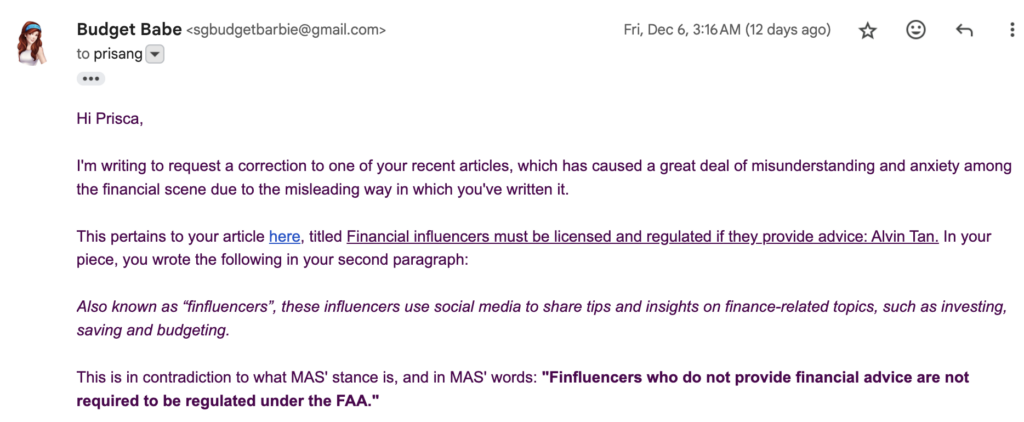

I have written to the original journalist of the article that started this whole saga, but unfortunately, she has ignored my email and there is still no update on her piece:

Prime Minister Lawrence Wong has also addressed this explicitly (including in response to my name) during his recent speech below. He made it very clear that even if the government were to regulate local finfluencers like Budget Babe, the population can still access information by overseas finfluencers which could be even more detrimental.

“Even if we regulate in Singapore, it is an open Internet. You can get all sorts of advice on the Internet, and we can’t stop people from accessing these things online.

If you know of any particular influencers who have crossed the line, let us know and we will have a friendly conversation with them.”

– Prime Minister Lawrence Wong, 2 July 2024

As far as I know, none of my finfluencer friends or myself have been called up for a “kopi chat” with the authorities so far. Do you really think they’re not watching our work, especially when folks are naming us explicitly in these dialogue sessions with the ministers?

Remember prominent overseas Youtubers of the previous era including CryptoNick, whom I called out here? Or these US-based influencers who were charged by the SEC for their stock manipulation schemes promoted on Discord and Twitter? Or Logan Paul, who is being accused of misleading his followers (which include Singapore-based followers, by the way) over crypto investments that have since lost money?

Are finfluencers really a systemic risk here?

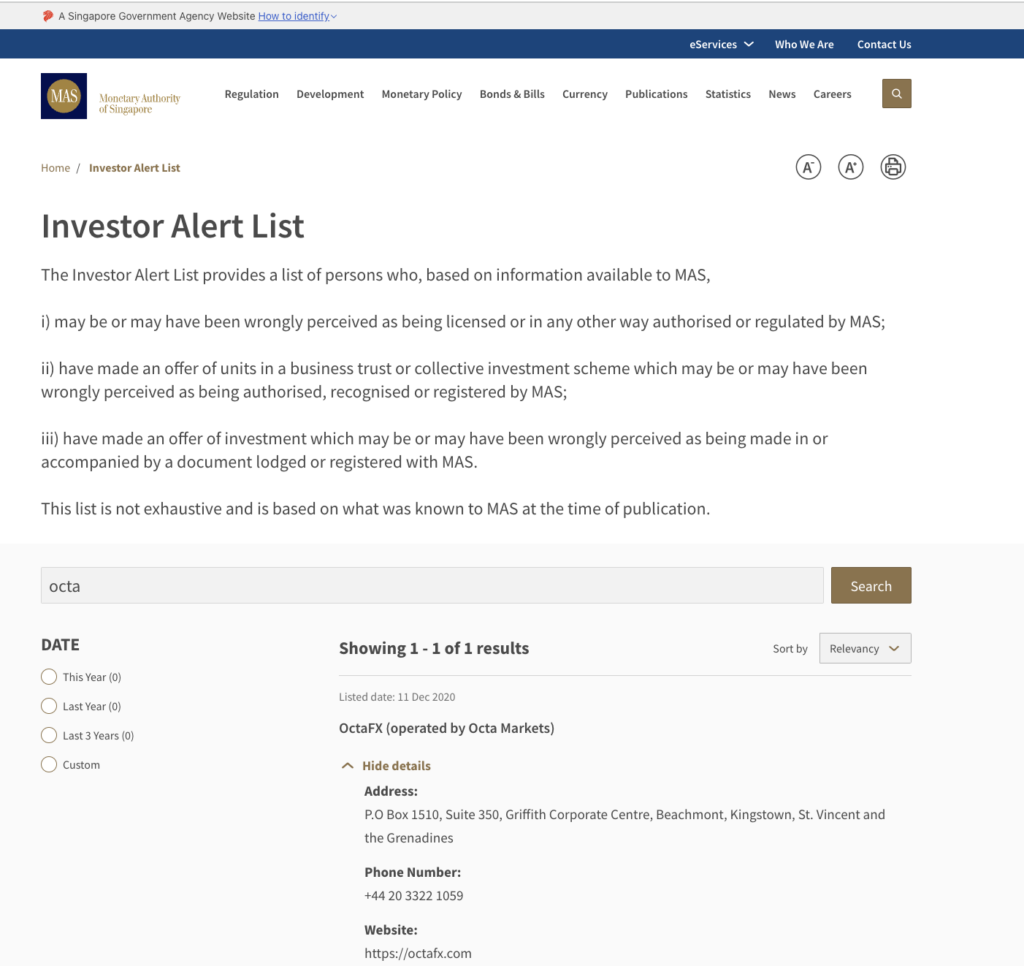

In today’s world, even finance brands are choosing to hire lifestyle influencers and celebrities to promote their platform and financial products. Remember EndowUs’ ads featuring Joanne Peh and Benjamin Kheng, that were so prominently plastered across our MRT stations? Or YouTrip working with food and travel creator Aiken Chia, or how about trading app Octa working with popular Youtubers Benranaway, Mayiduo and Simon Boy?

Adultery and trading? These videos, promoted by Mayiduo and Simonboy, reached over 1 million views combined. In contrast, most of us finfluencers do not even command such a massive reach…and neither do we want to be associated with Octa, which coincidentally happens to be on the MAS Investor Alert List.

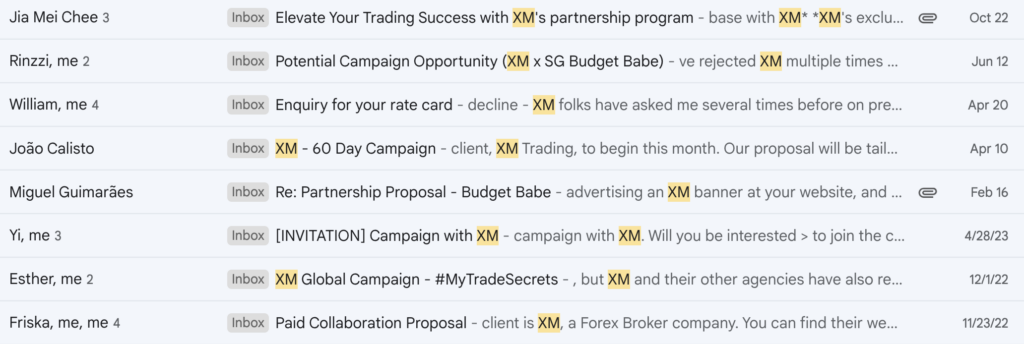

I’ve been offered gigs by forex and CFD trading platforms as well, which I’ve repeatedly turned down. Need proof? Here’s me turning down XM despite repeated offers in the last few years, because I’m conscious that not all of my followers may be able to manage the (higher) risks involved in FX and CFD trading and thus I have zero interest in promoting such a message to them:

But here’s what Ryan and Jonathan tell their followers about CFD trading instead:

“You need to trade futures or forex, and it needs to be a leveraged trade. If you’re looking at crypto, you probably need to go 20 / 50 / 100x. And if it’s forex, probably a 1000 times leverage. Investment requires a long time horizon. What trading futures allow you to do is you can make decent profits whether it goes up or goes down. In fact, the more it goes down and you short the market, you can make money.”

– Johnathan Chua, 2 November 2024

And who can forget Tammy Tay, who opportunistically rode on the previous crypto bull run to launch her NFTs for over S$400 each? The last I checked, these NFTs are hardly worth anything now. She later then disclosed on an interview with Jianhao Tan and Xiaxue that she lost a million dollars which was why she had to turn to doing adult content on OnlyFans. The curious question is, how much of that was from the crypto investments that she made (and was also recommending on Instagram to her followers)?

“”I’ve lost over a million dollars. It took 10 years to build my life savings, and it took only 2 years for me to lose it all.”

Bitcoin is now at over $100,000. If Tammy Tay bought Bitcoin between 2020 – 2022, even if at the peak of $60,000 then, she would still be in the green now. But, did she?

Finfluencers dare to speak out and call out BS

It is also worth pointing out that finance isn’t the easiest topic to tackle. It is also a very narrow niche – you’ll get better traction (and sponsors money) if you become a lifestyle, travel or beauty influencer instead. But most of us choose to do it because we feel passionate about educating people about finance, and happen to understand finance a little better than the average person.

This also means we can also smell out b*llsh*t when we see it in the sector.

Need a recent example? Many of us spoke out against Trust Bank’s recent card launch, where they hired many lifestyle and travel influencers to promote the “15% cashback” offer. We called it out for the misleading advertising, and highlighted how the highest cashback outcome you would ever get on the card was closer to 4+% and never anywhere near 15%, unlike what others would have you believe. A few of us then received an email from CASE later on to thank us for bringing it up, and who said that they had since spoken to Trust Bank to correct the misleading claims. Psst, the correction was made way beyond the campaign run dates, where it probably reached millions of eyeballs during that period.

There was literally no finfluencer who promoted Trust Bank’s card as having 15% cashback. Zero. But there were plenty of non-finfluencers who did.

If finfluencers needs to be licensed, then how about non-finfluencers who promote financial messages like forex trading, leverage and misleading credit card offers?

Is licensed advice necessarily better?

Last but not least, let us not forget that more consumers have lost money by taking the “advice” of licensed practitioners rather than listening to finfluencers:

- This 58-year-old woman earning $3,000 a month lost $200,000 after she was convinced by a bank sales representative to put into a product with a “better interest rate”.

- Many Singapore retirees (including my friend’s dad) lost their money by investing in Credit Suisse bonds recommended to them by their bankers, which were purported to be “safe”.

- Licensed insurance agents have cheated victims of money, including 6-digit sums like this or this case of over $300,000, just to name a few.

- Even licensed professionals can fall prey and become victims of a scam themselves, including a licensed fund manager in the case of Ng Yu Zhi Ponzi scheme.

To have a license today, you need to become a registered representative of a firm offering regulated financial services. This license usually comes with several requirements, including sales KPIs – but most of us finfluencers have zero interest in selling insurance policies or investment plans to our followers; we’re more motivated to teach them how to become savvier and manage their money better themselves.

The licensed professionals ask you to hand their money over to them to manage for you (at a fee), whereas we finfluencers tell you to never give your money to us under any circumstances.

So…is there even a relevant licence for us to get?