As promised, I'll be doing a series for beginners / students to consolidate a lot of the useful research and info that we shared during our last #dayrefinance meetup!

But before I continue the series proper, I thought I'll digress for today's post and focus on a topic that I've been getting quite a lot of emails on recently:

"Where should I put my angpao money into ah?"

Now that CNY is over, most of us probably got a few hundred dollars extra in our pockets thanks to all our kind relatives! (Thankew ah auntie next time I give your baby angpao back don't worry 😅)

Here are some suggestions on what you can do with them to grow your money!

1. Put in a high-yield savings account.

For those of you who already have OCBC 360 / UOB One / BOC SmartSaver, you should quickly put your money in so that you can get even more interest out of every dollar!

Remember to do it before the month is over or you'll be missing out on that extra interest…

Omg so many campers!! I stress lol will try to finish this in between work and before my dance later tonight…

2. Fixed deposits

DBS, CIMB and Maybank have a 1% fixed deposit promo ongoing for 24 months lockup, which will give you $40 if you put in just a measly $2000. (Seriously though if you only have $2000 my advice is not to even bother with FDs…)

If you have $10,000 to spare, RHB is now running a 1.125% promo for their 24-month FDs. That will give you the relatively highest interest rate of $225.

3. Singapore Savings Bonds (SSBs)

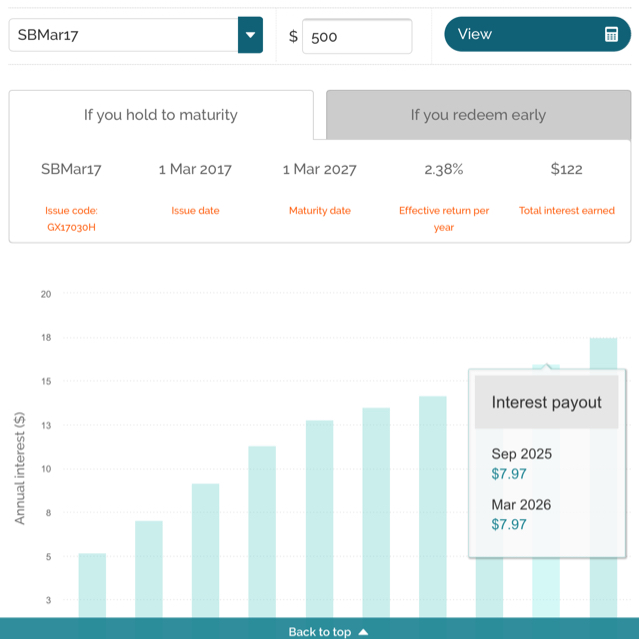

Can get 1/5 of your angpao money back as bonus.

I said FDs are terrible places to park $2000 because the sum is too small…I would put it here instead.

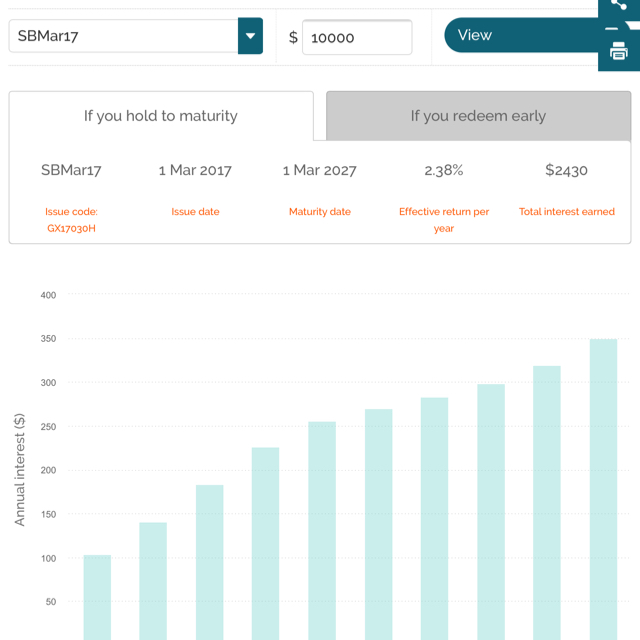

If you increase your holdings to $10000, you can get $2400+ extra NOT BAD RIGHT that's like a month of take home pay for a fresh grad without you lifting a finger (except for when you first buy SSBs la haha).

I like SSBs because they're relatively safe instruments – your money sits with the government – and they give you the flexibility of withdrawing your money anytime, unlike all the hassle you'll have to go through for FDs if you want to appeal your case for early renewal (anyone tried successfully before? My friend failed).

And you can buy a tranche with just your angpao money without any top ups! Most within reach leh.

4. STI Index

Search for ticker symbol ES3 on your brokerage under SGX and you'll see that today's price is just slightly over $3. One lot will cost you only $300, so if you got a little more angpao money this year you can buy 2 lots! #dayreinvest

(The share price chart so nice hor haha)

Beyond just buying 2 single lots, I recommended you guys during our #dayrefinance meetup at NUS that you can consider opening a POSB InvestSaver account to practise DCA (dollar cost averaging) while automating your investments every month. Start with your angpao money! 💰

(Not gonna talk about DCA today but if you're interested I have 2 to 3 posts on this previously here on Dayre.)

5. Top up your CPF

Your CPF is seriously one of the best financial tools Singaporeans have lah. Many financial bloggers and savvy finance gurus overseas envy us for having access to such a system, yet it boggles me whenever folks like Roy Ngerng or other Singaporeans complain about having their money "locked away". I prefer not to waste my breath on something I can't change, and to spend the effort on finding out how I can make the system work to my favour instead.

With interest rates up to 5% on your CPF, there is NO OTHER RISK-FREE investment tool out there that can guarantee you returns at such a level! You could put your angpao money into your CPF if you like. I've provided a step by step guide on my blog before so you can use the search function to find it if you're keen to make this transfer.

(Bonus): Invest in yourself!

Last but not least (number 6? Haha) you can also choose to use the money to invest in yourself. Whether it is utilising your SkillsFuture credit with your angpao top-ups, or spending on something you feel is a worthy investment (#dayremakeup or #dayrebeauty also can if you see it that way), go ahead!

I'm contemplating spending my angpao money on another fat freezing session with Astique because I'm worried I won't lose my tummy in time for my wedding…should I?!?!?

There are also a few courses out there that can teach you how to invest. I've promo codes for some of the ones I've personally attended and found good, so if you're interested you can email me and I can share them with you!

My criteria for working with these course providers is that they have to:

📌 provide good value and teach ACTUAL skills, not just a preview. If I can't apply what I learnt immediately (formula or method) after walking out of your class, then that's a fail in my books.

📌 cannot charge attendees more than $500 for a course. I use this as a benchmark cos I've gone to quite a few myself and there's so many great ones for cheap, just that people aren't aware cos these trainers don't spend so much on marketing to promote (also why they're cheaper too right?)

📌 I MUST be impressed with the coaches, more brownie points if they make the effort to become my friend. Haha! If you're just all talk but no say then sorry you don't qualify to be a teacher in my eyes.

Anyway this isn't a selling post and lest critics say I'm being sponsored to write this, I'm gonna stop here. Go find your own investment courses, but if you wanna go for the ones I went for and liked, you can drop me an email (contact at the bottom of my blog) and I'll send you the promo codes / signup links.

Phew finally finished writing this! Omg so many of you guys camping! Stress leh was rushing cos I'm going off the grid tonight and won't be checking my phone till after midnight.

What else did you guys do with your angpao money! Share share leh.