How can parents in Singapore open a joint investment account for their child? If you’re thinking of exploring this as a way to manage your children’s investments while also teaching them from young on how to invest in the financial markets, here’s how you can do it!

It hasn’t even been 10 years since I graduated, but university fees are already up by at least 30% from what I remember. In 20 years, how will that figure look like?

The Straits Times ran a 2016 report on how getting a degree in Singapore is set to be costlier, and a later study showed how Singapore parents were spending an average of $21,000 on their child’s university education.

I’ve no qualms that we’ve to prepare for at least $100,000, if not more, by the time our child turns of age.

Why You Need To Invest For Your Child

Given the current economic climate and rising inflation, just saving money won’t even be enough. We’ll have to invest instead, and leverage on compound interest to get to where we need the money to be.

If not, even saving money alone might not be enough, not to mention the possibility of our work being made redundant by technology in the coming years.

The problem is – as anyone who juggles between work, elderly parents and young children will tell you – there is barely enough time.

For a fuss-free solution that will take away the planning and monitoring involved otherwise, a managed portfolio like FSM MAPS might just work for you.

I spoke with John*, who has chosen this for his children’s portfolios, and the rationale behind why a managed solution – that allows him to focus on his career and family without having to worry about the market – works best for him.

(*Name has been changed to protect privacy.)

Background Profile

John is a successful high-flyer in the corporate world. As a father in his 40s, John has 3 young children (all of whom are under 8 years old). While he believes in saving for his children’s future, his main challenge is finding enough time to do all the research and portfolio management, given how his work demands most of his focus and energy.

As a result, he decided to open an account for each of them where he invests in a portfolio of unit trusts, ETFs and fixed income instruments.

Start Investing Early

John has been investing for his children ever since they were born, and even started up a beneficiary account with each of their names to separate the investments. By starting early, he was able to set a longer investment horizon of 15 to 20 years, which then gave him confidence to go for more mid to aggressive investments.

For my kids, I opt for a portfolio of 70% equities and 30% fixed income.

When they turn 18 or 21, he intends to give them their portfolio money, which can then go towards their university fees or serve as startup capital for a business of their own.

By starting early, you’ll have a longer investment horizon ahead, which can give you the confidence to opt for higher growth options that may not materialise (or can be volatile) in the short term. Closer to when your child turns of age, you can then move the money into safer, fixed-income instruments instead.

Choosing The Right Investment Strategy

There are many investment strategies that you can adopt, but the best approach will be the one that works for you and your personal circumstances.

During the day, I work as a General Manager in a listed company. My job, family and other responsibilities keep me busy enough so I don’t have enough time to keep tracking the stock markets.

He also didn’t want to risk jeopardising their portfolio with any emotional buy/sell stock decisions that he might make in the short-term, so he decided the best way for them would be a structured and disciplined approach.

Keep Fees Low

Investment fees can quickly eat into your returns, so look for low-cost investment solutions instead. (Read: How 1% in investment fees could mean giving up 1/3 of your future wealth)

The more fees you can eliminate, the more you’ll have for your actual investments.

John pays 0.5% portfolio management fees annually for FSMOne MAPS without having to pay any upfront sales charge, and as a result, he gets a holistic portfolio without any need for him to rebalance at the end of each year.

Invest A Fixed Sum Regularly

John started off with $1,000 as base capital for each of his kids, and continues to invests a fixed sum on the 8th of every month into each of their portfolios. Part of the base capital came from the Baby Bonus which he received from the government upon the birth of each child.

We made sure that their insurance are all covered before thinking about how much to allocate to the kids investments. After about 6 months, or when you feel the costs have stabilized, then you can think about adding to the capital injections if you’re comfortable with it.

Setting aside a fixed amount each month is the easiest way to build and enforce discipline.

For instance, while $500 each month may sound like a good start, but if you’re planning on having 4 children, that’s a total of $2,000. If you’re planning to have multiple kids, remember to set a sum that you can comfortably invest without having to draw down from your emergency savings.

Choose The Best Investment Tool

“As a first-time parent, I found parenthood incredibly hard to get used to. That’s why for my two elder children, I wanted to outsource the investment work to fund managers instead, and so I invested into unit trusts.

We’ve gotten used to the demands of parenthood over the years, so when my third child was born, I changed my strategy by going with FSMOne Maps.”

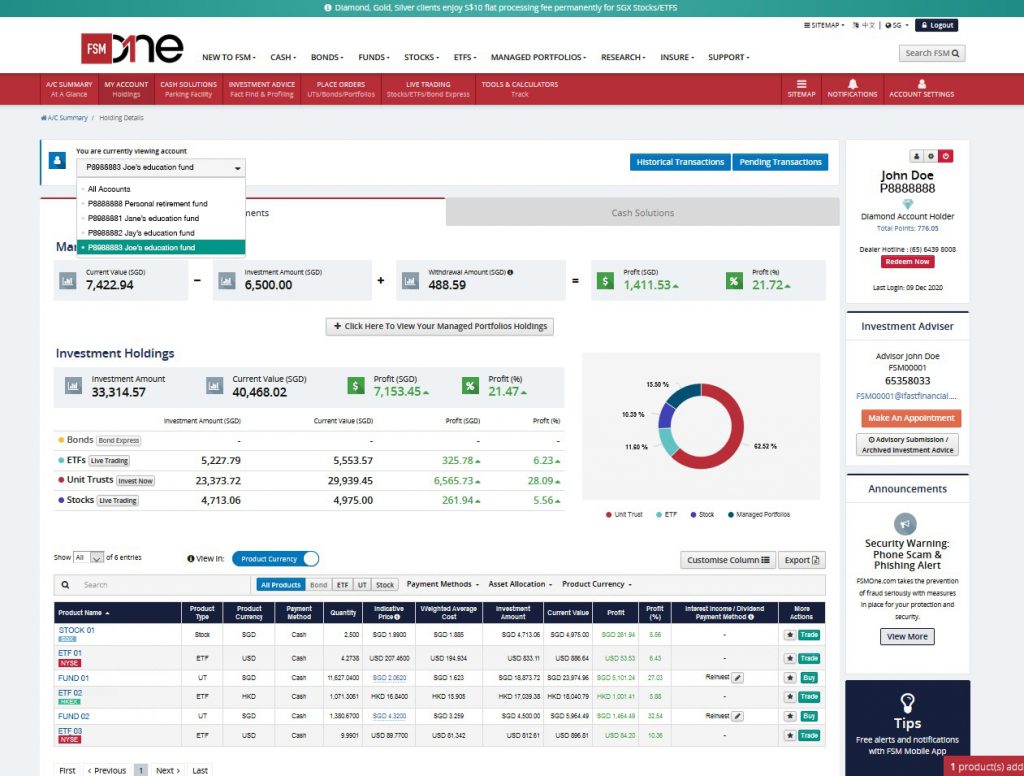

As a result, John’s portfolio for his third child consists of 8 – 10 unit trusts and ETFs in total, spread out across 20% US equities, 25% Asian equities, 10% in digital economy plays and other themes. You can also view the managed portfolios here. (John’s portfolio is under the risk level option of moderately aggressive.)

Consider A Beneficiary Portfolio For Your Child

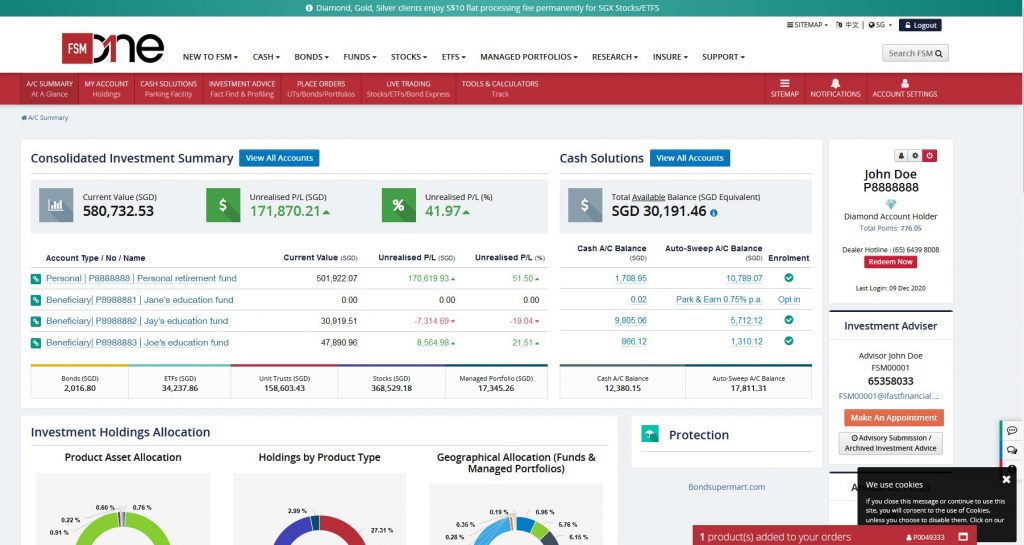

John keeps his own investments (for retirement) separate from that of his children, by creating a beneficiary portfolio for each of his kids.

Although he is the main account holder, the assets are under each child’s name. This helps him to manage the investments easily at one glance whenever he logs into his account.

Since it is not a joint account concept, his children cannot log in and check holdings. As they are still young, they do not yet know that this investment portfolio exists, either.

Once the child turns 18, the parent can transfer the assets to the child’s FSMOne account, and this is exactly what John intends to do.

Is FSMOne MAPS the best way to invest for your children?

As parents, our plates are almost always full. We’ve to spend time ferrying our kids around, helping them with their homework, and so much more. At the same time, we’ve to grow our careers, while also looking after our own parents, who are starting to grow old and weak.

Life can get in the way of your investment goals.

So to prevent that, a disciplined approach via FSMOne Maps can be incredibly useful. What’s more, they’re the only one that gives you the ability to set up beneficiary accounts for your children, making it even easier to manage and transfer your investments in due time.

*** Sponsored Message from FSMOne ***

Solutions for parents and investors

If you’re a parent looking to invest for your child, check out FSMOne’s Regular Savings Plans (RSPs) for unit trusts, ETFs, as well as managed portfolios under MAPS.

If you’re more hands-on and want more control over your choice of investments, you can also opt to create your own ETF portfolio from as little as $50 per month per ETF.

For a start, check out their awesome ETF Focus List featuring 50 picks across the US, Hong Kong and Singapore markets. Fees are also low at just 0.08% (subject to a minimum of SGD 1 for SGX stocks, USD 1 for US stocks, or HKD 5 for Hong Kong stocks).

With a team of portfolio managers and research analysts doing the heavy-lifting, and with minimum investment amounts as low as $1,000 and at annual portfolio management fees no more than 0.5% (that’s just $0.42 per month for $1,000 invested), investors would be able to focus on their work and family and be assured that their portfolios are being taken care of.

You can start an RSP into FSM MAPS from just $500 per month, thus providing investors like yourself a disciplined way to stay invested without having to fork out huge sums of investment monies on a monthly basis.

Disclosure: This post was written in collaboration with FSMOne. John* is NOT a fictional character – he is a real-life customer of FSMOne who very kindly agreed to be interviewed for this piece.