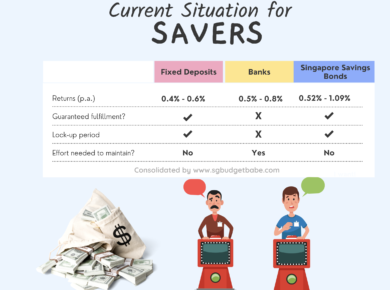

Savers Can Check Out this 1.2% p.a. Plan for 2 Years (Guaranteed Returns, Single Premium)

For savers with at least S$10,000 looking for an option that will give you at least 1.2% p.a. guaranteed returns for the next few years, which will serve you better – your bank account, fixed deposits, SSB, or short-term endowment plans?