Needless to say, being pregnant in Singapore isn’t a cheap affair. There are many costs to think about, and the bills can easily add up, leading to stress over a lack of finances if you aren’t prepared for it.

What should one expect to spend and save up for when you get pregnant? Here are some costs to think about (numbers are estimations based on my own pregnancy journey this year):

Pre-natal / Pregnancy costs

|

| Image credits |

Gynae visits ($1,000 – $3,000)

Each consultation will easily set you back by $100 – $300+ depending on whether you’re seeing a public or private gynae, and how popular they are. Some offer the option to take on a package after your fourth month, which helps to save on consultation and ultrasound scan costs, but you’ll still have to pay for your own supplements / medications.

Pre-diagnostic tests ($400 – $1,500+)

Most expecting mothers in Singapore would have to undergo three tests throughout the duration of their pregnancy:

- Down syndrome test between 12 – 14 weeks (OSCAR is the cheapest but also has a higher rate of false positives)

- Fetal assessment test between 20 – 22 weeks

- Gestational diabetes test in your fifth month

Depending on which tests you opt for (especially to test for Down Syndrome), these can cost you anywhere from $395 – $1500+.

Prenatal classes ($300 – $1,000)

If you’re going for prenatal classes (whether for exercise or for knowledge), these cost money too! Costs vary depending on the number of sessions and types of classes you go for, but expect anywhere from a few hundred to a few thousands if you’re going with a branded or more well-known provider. My husband and I opted for a one-day intensive workshop at Thomson Medical.

Maternity clothes

Let’s get real – you’ll probably have to spend some money on new clothes to fit your growing bump, unless you’re lucky enough to have friends who will give theirs to you secondhand (and provided that they fit!). You can read my consolidated budget tips here for maternity wear, but the key tips I would share is to stick with loose clothing for your first and second trimester, and then surviving your second and (the start of your) third trimester on clothes that are 1 – 2 sizes bigger. When you have no choice but to buy new clothes towards the last 2 months of your pregnancy, go for maternity-convertible-to-nursing outfits so that you can continue wearing them even after you’ve delivered your baby. I got 3 of such sets for work from Dear Collective, and the rest from ASOS Maternity when there were sales.

Delivery costs

|

| Image credits |

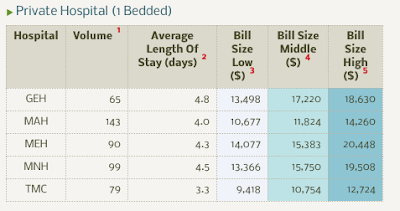

Hospital package ($2,000 – $15,000)

Whether you’re going for a natural birth, scheduled Caesarean or end up with an emergency Caesarean, the costs rise in that very same order. If you’re unsure how much you ought to expect, you can check out this really useful guide by MOH on the average bill sizes for delivery. Note that the higher rates doesn’t mean that’s the highest, because 1 in 4 patients pay more than the highest figure stated. In fact, my friend ended up with a $18,000 bill because while his wife initially opted for a natural birth, circumstances warranted an emergency C-section at the end.

Your duration of stay, type of medical consumables and pain relief (laughing gas, spinal block, epidural, etc) will also bring up the costs (in that same order).

Gynae and other professional fees ($2,500 – $8,000)

Aside from the hospital fees, the other component in your hospital bill that has the most variation (because it depends on the professionals you pick) would be the professional service fees incurred by your doctor, anaesthetist and child’s pediatrician. Your gynae will most likely charge you a fee per visit to the hospital, so if you’re in labour for a really long time, there might be multiple visits to pay for. In addition, there will be a gynae fee for carrying out the delivery as well. Private gynaes charge different rates for different procedures so there’s a huge range of costs to expect – check with your own gynae directly to get a better and more accurate estimate for you to plan towards.

Part of these costs can also be paid out of your Medisave (or your husband’s):

- Up to $900 for pre-delivery / prenatal expenses (so do remember to pack your receipts in your hospital bag for submission)

- Between $750 – $3,950 for surgicial procedures ($750 for normal vaginal delivery, $1,250 for assisted vaginal delivery, and higher for c-section operations)

- Up to $450 per day in hospital

Insurance costs

|

| Image credits |

Maternity insurance ($350 – $550)

To protect against unexpected pregnancy or delivery complications, you can either save up more on your own, or opt for maternity insurance to offset these costs. There are generally two types of maternity insurance plans available in Singapore – the standalone plans and the bundled options. Make sure you pay attention to the conditions covered and the underwriting criteria. For a detailed study across price, coverage and exclusions, you may refer to my 2018 comparison table here for when I was shopping around for my own.

Insurance for yourself and your spouse

With a new dependent, it is crucial that you and your spouse are financially covered so that lest anything happens to either of you, the insurer(s) will provide a payout that can then go towards covering your child’s future expenses. Consider hospitalisation, personal accident, term / life with critical illness riders, and income replacement policies for a start. No cost estimates for this section provided because what and how much you choose to be insured for will affect your premiums paid, so it’ll be best to seek advice from a financial adviser(s) and get quotes so you can decide what falls within your affordability.

Insurance for your child

What insurance policies do you need to get for your newborn? In my view, hospitalisation and personal accident plans are absolutely essential, term/life plans are debatable, whereas endowment and ILP can be skipped provided that you’ll do your own savings and investments. You can read more about each policy and its varying functions here, as well as which ones I recommend as must-haves vs. the good-to-have-if-you-can-afford-it. The premiums will also vary according to the level of coverage that you choose for your child, so there isn’t any cost estimates here either.

|

| Image credits |

P.S. I tried a few prenatal massages and eventually booked with Post Natal Singapore for mine as they offered the best value-for-money, especially if you purchase during a baby fair or roadshow where they give out pretty good discounts and freebies.

Newborn-related expenses

|

| Image credits |

Vaccination expenses ($1 or up)

Here’s a tip – you get the vaccines for free / at a highly subsidised rate if you go to the polyclinics instead of a private paediatrician. This is because all recommended immunisations under the National Childhood Immunisation Programme (NCIP) are free, thanks to MOH and government subsidies!

Paediatrician expenses (varies)

Depending on how healthy your baby is, costs for paediatrician visits can vary quite widely under this aspect as well. If you need repeated visits for fever, colic or other conditions, then you’ll have to pay accordingly per visit and treatment.

|

| Image credits |

So how much should I save?!

That depends on how much you intend to spend, really, but start budgeting across the above categories and work out a rough budget that you’ll need to start saving towards so that you’ll be well-prepared. To outsource financial risks (hospitalisation, pregnancy complications, etc), look to insurance to cover that gap, unless you prefer to self-insure the entire sum by yourself.

As a rough gauge, my husband and I initially targeted $20,000 before we realised that some of our friends (especially those who ended up with an emergency C-section) spent close to that sum alone on their hospitalisation and delivery fees. Hence, we’ve since revised our baby budget to $30,000 to last us throughout pregnancy and the first 4 months of our baby’s birth.

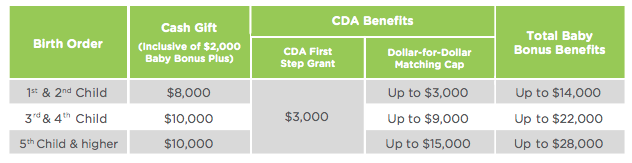

Where to park my child’s savings and government grant?

The POSB Child Development Account!

To help us save further on our son’s medical, dental and hospital expenses after he’s born, we’ll be using our POSB Child Development Account together with our Passion POSB Debit Card which gives us 3% rebate for such expenses. I’ve reviewed this previously against the other CDA options in Singapore and felt that this was the best account for us to open to get our CDA grant of $3000 and also the government’s matching of up to $3,000 (since this is our first child). There’s also 2% interest p.a. with no minimum balance, which is relatively higher than many bank accounts that offer basic interest of 0.05% onwards.

You can also see my comparison here.

We decided to go with POSB Child Development Account as it has:

- 3% cash rebate on hospital, medical and dental expenses (the only one to offer this)

- the best variety of merchant offers including baby essentials, Lazada, RedMart and more

- we can also get a free infant flight on Singapore Airlines to travel with baby Nate next year!

Disclaimer: This post was written in collaboration with POSB, whom I approached after independently reviewing their CDA offering (here) and concluding that they were indeed the best in the market for my family and my baby.