Insurance

Investing

The Challenge with Personal Finance Today

Managing one’s personal finances today looks very different from what it used to be for our parents’ generation. No wonder more people are falling behind and are unable to get…

2022 Financial Review – A Challenging Year

Phew, what a year 2022 has been! As it comes to an end, this is my annual review of my finances to check where we are now and ensure that…

FTX Collapse: Could the same happen to digital stock brokerages?

In the light of FTX’s collapse, a lot of blame has gone towards the lack of regulation, governance controls, and the ways that its founder-CEO used its customer funds. A…

How you can get 5% p.a. guaranteed* for 4 months

Is moomoo SG’s latest “5%* p.a. guaranteed” offer legitimate? How is it possible that they are able to guarantee returns on an investment product, even if it is a low-risk…

How to withdraw and safekeep your own crypto assets

This crypto winter has been especially brutal, and last week, shockwaves reverberated across the whole sector as FTX – the fourth largest crypto exchange in the world – declared bankruptcy…

Stop Working So Hard For High Savings Interest – Just Open CIMB StarSaver

If you’ve always wondered why we, as consumers have to jump through so many hoops just to earn a high interest rate on our savings, you aren’t alone. In fact,…

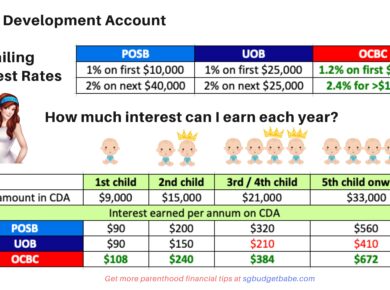

Which is the BEST Child Development Account (CDA) to Open? (2022 Update)

What a difference a year makes! It has been only 1 year since I last revised my article on Baby Bonus benefits and a comparison of which Child Development Account (CDA)…

Are regular health screenings really necessary?

If we’re feeling all fine and dandy, is there still a need to spend on regular health screenings to check for any underlying conditions? With the wide range of screening…

Capital-guaranteed and low-risk options for savers in 2022

If you’re still earning anything less than 1% on your cash, it is time to wake up and do something…before rising inflation erodes the value of your dollars any further.…

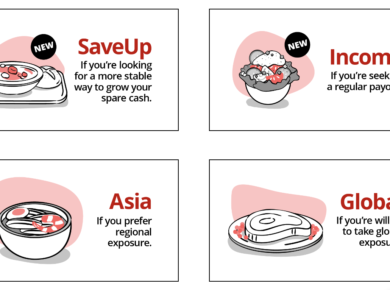

Are the DBS digiPortfolio latest offerings worth investing in?

When DBS launched digiPortfolio in 2019, it shook up the entire market for its low starting capital and management fees (which was almost unheard of among banks at that time).…

-1-390x290.png)