If you’ve just received your annual bonus or have savings that you won’t be using in the near term, leaving it in your bank might not be such a good idea anymore, especially as inflation continues to creep upwards. Here are some alternatives you can consider instead.

Even for those of us who are able to resist lifestyle inflation (i.e. spending more as your income goes up), we’re not immune to the effects of economic inflation. But what’s more worrying is that the latest data for Singapore showed our headline inflation has not only been creeping upwards, but is almost at the highest in the last decade.

Not only are food prices and transport fares going up, but in general, almost everything is more expensive today than before. The same goes for higher oil and gas prices (which have gone up even more due to the Russia-Ukraine crisis) and pandemic-related supply chain disruptions such as port closures, global commodity prices have been on the rise as well.

In order to counter the creeping inflation and ensure price stability in the medium term, the Monetary Authority of Singapore (MAS) acted to further tighten its monetary policy earlier this year (ahead of schedule). But will it be enough?

Why is inflation bad for savers?

Imagine you have $10,000 in your bank savings account which pays you 1% interest per annum which means after a year, you will have $10,100. But if inflation is running at 4%, you would have needed to generate $400 of interest on this same capital in order to maintain the same buying power that you started with.

Hence, even though you “earned” $100 from your savings, you have a poorer buying power now. That’s what we mean when we say your savings get eroded by inflation.

Sidenote: Instead of 1%, Singapore’s banks tend to pay just 0.05% on most savings accounts, including on your Supplementary Retirement Scheme (SRS) funds.

Now, if you’re about to retire in a few years time, this means that you effectively have “less” for your retirement – especially with even basic food prices rising. And if inflation persists or goes even higher, your money gets you less food / transport / living essentials as each year passes. Hence, the likelihood of you not having enough to live on becomes more and more stark.

And if the inflation rate on your main expenses go up higher than your salary (e.g. medical inflation tends to outpace core inflation), then it’ll be even worse.

Add in the impending GST hike of 2%, and you’ll soon see that keeping your money in the bank may probably not be the wisest thing to do.

How can I stop my savings from being eroded by inflation?

There are 2 ways to beat inflation: either cut back on your expenses, or grow your money. But if you’re already operating on a lean budget and have nowhere else to cut, you’ll have to grow your money instead. This can be done through a variety of instruments – fixed deposits, endowment funds, or even investments.

At the time of writing, the highest fixed deposit is:

- Hong Leong Finance: 0.90% p.a. for 36 months (minimum $20,000)

- CIMB: 0.75% p.a. for 18 months (minimum $10,000)

With rates like these, it is no wonder that savers are now turning to short-term endowment plans with 1, 2 or 3 years of commitment. Not only does it keep their funds safe (e.g. from scammers), but also allows them to at least get more back than what they would have otherwise had they left it in the bank.

If you’re looking for rates higher than 1%, here are some other instruments you can consider as well:

- Singapore Savings Bond (SSB): 0.71% p.a. for the first year (minimum $500) or an average return of 1.41% p.a. in 3 years

- GREAT SP Series 6: 1.68% p.a. after 3 years (minimum $10,000)

If you prefer an option that retains full liquidity in exchange for a lower payout rate, then the SSB could be a good choice – you get 0.71% in the first year, and if you leave it to compound, this grows to 1.17% after 2 years, and 1.41% at the end of 3 years.

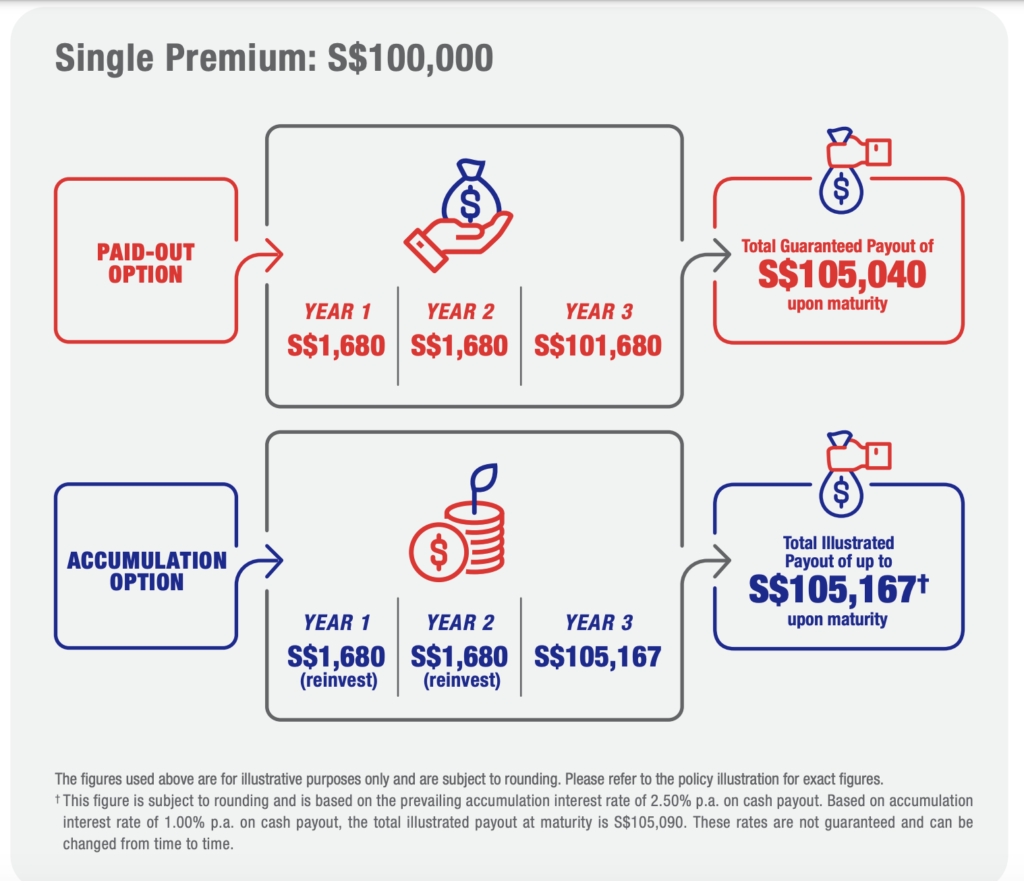

However, if you already know now that you’re unlikely to need the money for the next 3 years, then you might be better off applying for the GREAT SP Series 6 instead, as you’ll get a higher rate of 1.68% p.a. after 3 years. What’s more, you can opt to get paid the 1.68% each year, so you get some cash while waiting during these 3 years. Otherwise, you can also leave the payout to accumulate so that you walk away with a potentially higher payout upon maturity of the policy.

But what if banks raise their interest rates anytime soon?

With the Fed’s interest rate hike last week (with more to come later this year), some people are cautious and are hoping that this will in turn, lead to our banks here in Singapore to start offering higher interest rates on savings accounts as well. But even the Fed has said so themselves that they may or may not be able to roll out their hikes because of the uncertain environment, so it is up to readers if they want to count on this happening.

My view is, even if that happens, banks will likely implement prerequisites for consumers to fulfil before they get to enjoy the higher interest. This could include criteria such as having to spend more on your credit card, add regularly to your deposits every month, take up a home loan with the bank, or even purchase one of their investments or insurance products before you qualify. After all, this has become the new norm for high-yield savings accounts in Singapore where consumers are made to “work” to get a higher interest.

Except that if you can’t meet their criteria or have already maxed out this avenue (the higher interest rates are usually capped to a limit e.g. the first $80,000), then the rest of your cash is still effectively earning only the baseline interest rate of 0.05% p.a.

Which means you still need to find another place for your funds.

GREAT SP Series 6

The demand for the previous GREAT SP Series were so high that they were fully subscribed within weeks of launch. Hence, Great Eastern has recently announced that they’ve launched another tranche – good news for those who missed out previously.

GREAT SP Series 6 is a single-premium endowment plan and lasts for 3 years, which provides 1.68% p.a. guaranteed returns upon maturity. Here’s what you need to take note of:

- 1.68% p.a. guaranteed returns upon maturity

- Minimum premium starting from $10,000

- Guaranteed returns is applied to entire premium amount (unlike a tiered payout model) i.e. you could sign up with $100,000 and still get 1.68% p.a. on the full sum upon maturity

- Comes with insurance coverage against death and total and permanent disability (TPD)

- No medical examination or underwriting required

Who it could be good for

As long as you have spare cash that isn’t earning anything more than at least 1.5% for the next 3 years, then it is worth checking out GREAT SP Series 6.

Interestingly, many of my readers subscribed to the previous tranches on behalf of their elderly parents, as it was:

- a good way to not only protect their funds (since the capital is guaranteed upon maturity)

- a decent rate of return

- and also get the benefits of basic insurance coverage while doing so

It is also important to consider your options against other alternatives i.e. where else can you put this sum of money, and might you be able to secure a higher rate of return there? Many of my readers’ have elderly parents who are no longer earning an income / do not use a credit card / no longer have a home loan to finance. In most cases, these people would not be able to meet the usual criteria set by certain bank accounts and thus do not qualify for higher interest.

Of course, note that putting your money in a bank / fixed deposits gives you the flexibility to withdraw anytime without any penalty on your original capital, unlike short-term endowment plans.

If short-term endowment plans sound like something you’ll find advantageous (whether you have $10k, $20k, $50k, $200k or more), you can check out more information on GREAT SP Series 6 here.

Disclosure: This post is written in collaboration with Great Eastern, who fact-checked the provided product information about GREAT SP Series 6. All opinions in this post are mine.

T&Cs apply. Protected up to specified limits by SDIC.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person. You may wish to seek advice from a financial adviser before making a commitment to purchase this product. If you choose not to seek advice from a financial adviser, you should consider whether this product is suitable for you.

Important Note: As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value (if any, that is payable to you) may be zero or less than the total premiums paid.