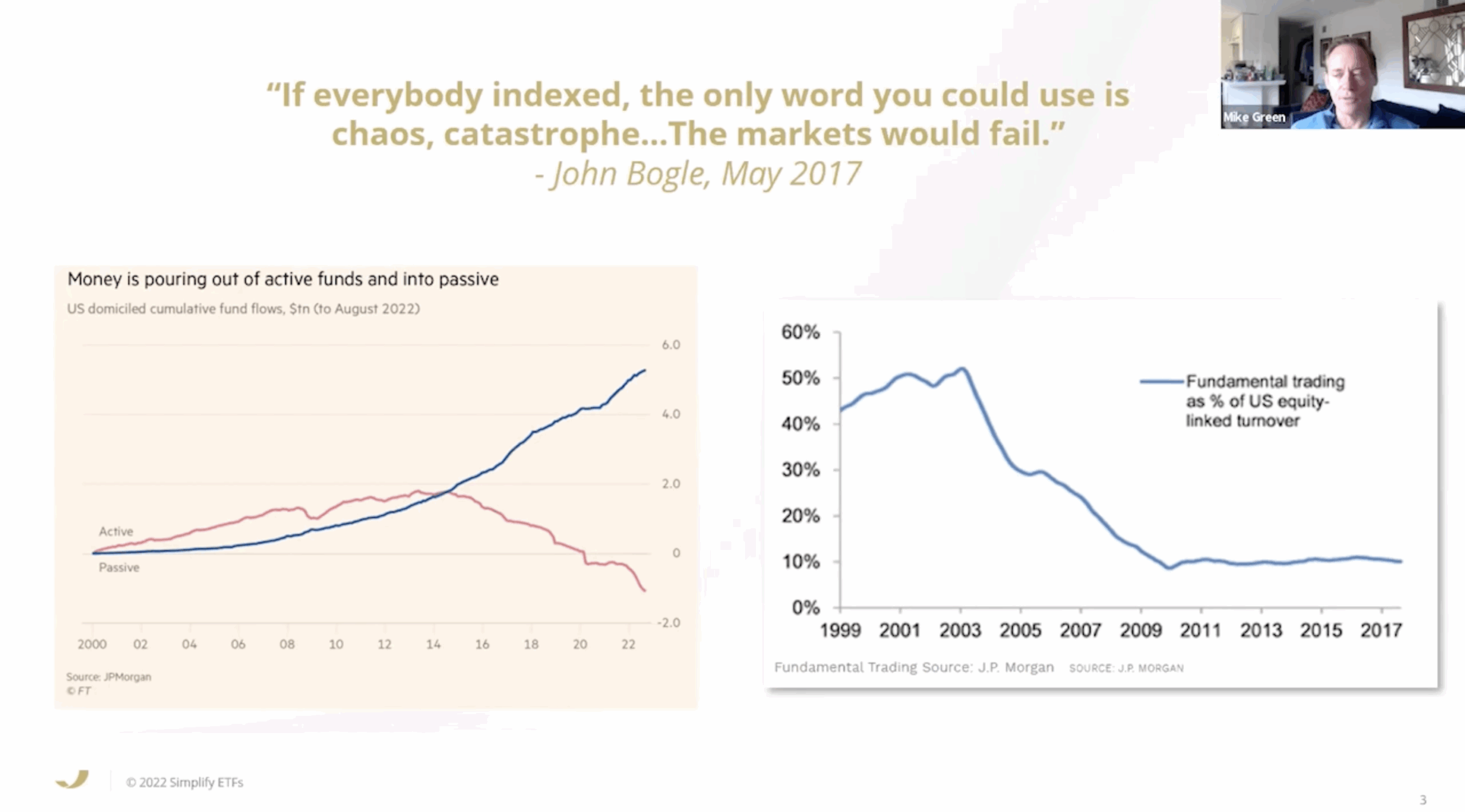

Will simply buying the S&P500 be enough?

The S&P 500 index, currently trading at a 22 forward P/E ratio, can be considered expensive right now by almost any measure. And historically, long-term returns following periods of high valuations haven’t been very good for the major indices.