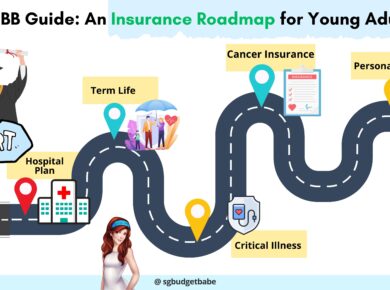

Adulting 101: An Insurance Roadmap for Gen Zs

“I just hope nothing happens to me” is a poor plan for your future. Gen Zs, this is my open letter to you. Take it from this Millennial personal finance mama who is (i) not an insurance agent but (ii) willingly pays for insurance to protect my entire family. I may only be a few years older than you, but I’ve seen more of life to know what it’ll be like without protection.