Insurance

Investing

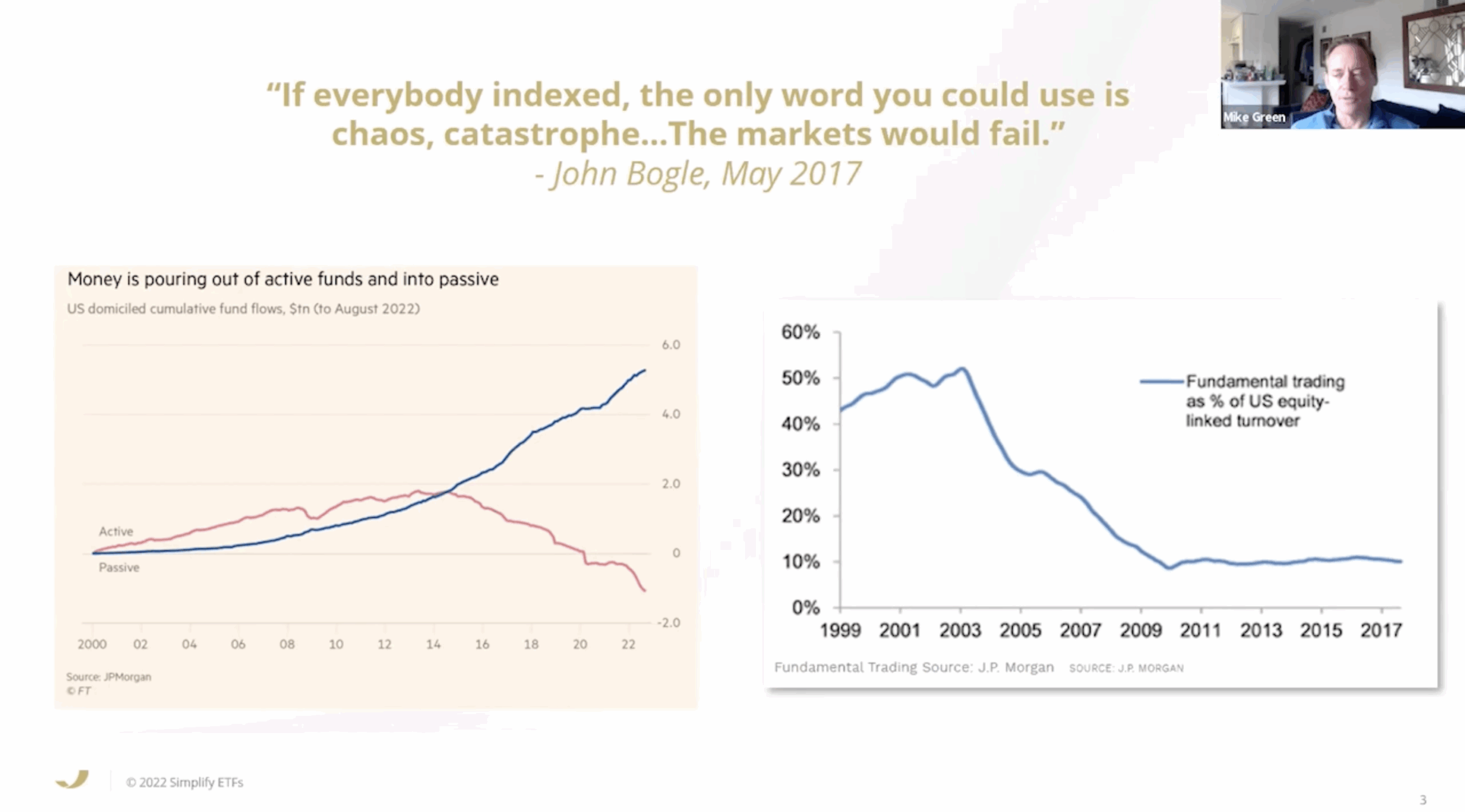

Will simply buying the S&P500 be enough?

The S&P 500 index, currently trading at a 22 forward P/E ratio, can be considered expensive right now by almost any measure. And historically, long-term returns following periods of high valuations haven’t been very good for the major indices.

Community

It has been a long-standing tradition of mine over the last decade that once a year, I’ll carve out some time to hold a free Investing 101 workshop for my…

Here’s how you can earn miles on your income tax payments

Disclaimer: My bias towards CardUp is real, especially given how it has been a fail-proof solution for me for the last 8 years. But here’s how the other options to…

Raising a family in Singapore? Here’s how Budget 2025 can help to offset costs

The best part about this year’s Budget is that the Government is giving more financial support to families with children, which helps to ease the costs of raising them. Large families with 3 kids or more receive more perks!

How to invest in the S&P 500 on SGX

Did you know you can invest in the S&P 500 directly on the Singapore Exchange (SGX) without having to go through a foreign custodian? What’s more, since it is listed on our local exchange, you can even use your own SRS funds for it and own it in your very own CDP account!

How Investing Regularly Can Help You Hit a $1 Million Portfolio

You may think having a $1M portfolio is a dream, but the truth is, this is more achievable than most people expect. Similarly, when I first started investing, I did…

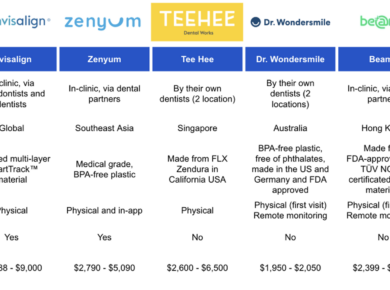

How to choose between clear aligner brands and straighten your teeth

What is the best way to straighten your teeth if you haven’t been born with a set of perfect, pearly whites? With options ranging from metal braces to clear aligners these days, which is the most cost-effective choice?

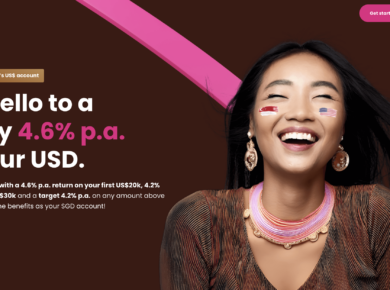

Is Chocolate Finance’s USD account and card worth getting?

In its latest move, Chocolate Finance now offers a Visa card earning 2 Max Miles per dollar to complement their upgraded managed account offering in both SGD and USD. Should you apply? Here’s what you need to know.

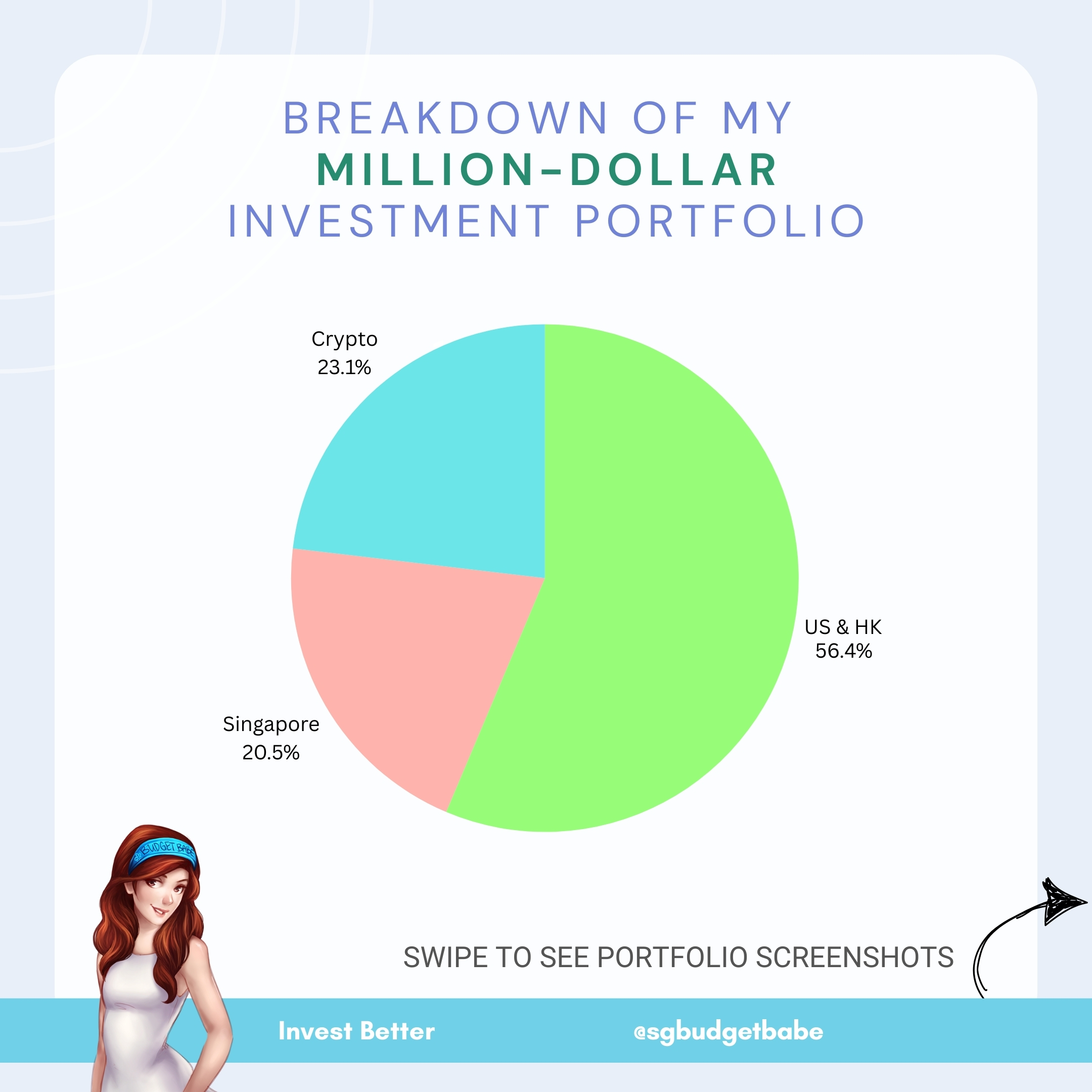

Breakdown of my $1M investment portfolio

Ever since I revealed publicly about hitting the much-coveted millionaire milestone I had set for myself back in 2014, many of you have reached out to ask about the breakdown…